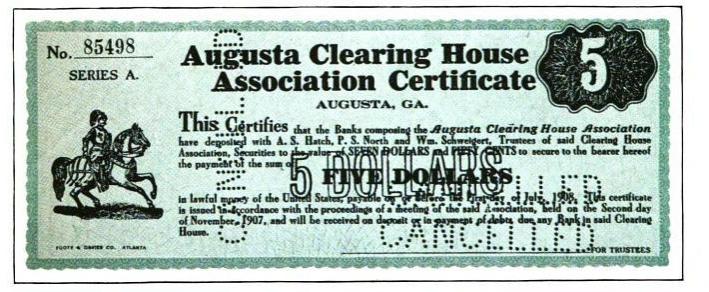

I suspect the one redeeming the bill for value is removing the bill from being Private Federal Clearinghouse Credit to United States Public/Social Credit. Feel free to search books.google.com for information about clearinghouse certificates. Some of the pre-1913 clearinghouse certificates looked an awful lot like Federal Reserve Notes look today.

Its important to study the fundamentals. The central banks are

clearing houses or '

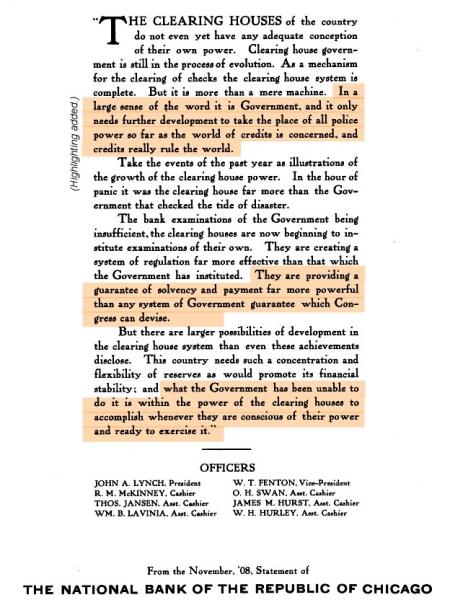

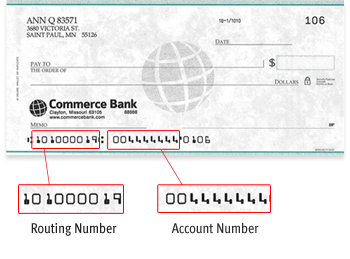

clearing corporations'. AFAIK it is the Federal Reserve Board of Governors issues them *to* the banks and they do not issue Federal Reserve Notes themselves for CIRCULATION (although keep in mind that checks, money orders and the like could be construed to be a form of currency). A 'bank' is a 'store' or a 'resevoir' it is not a generator except perhaps by induction. A piggy bank doesn't generate coins, it is a place for storing them. The currency comes from the U.S. Department of the Treasury not from the Federal Reserve Bank. The Promissory Notes on mortgages are neither issued by the Federal Banks nor by the State Banks. Since banks pass checks and such between each other, they need a common place to settle accounting between each other. That is what the 12 Federal Reserve Banks facilitate. When a 'national' or state bank in Chicago needs to clear a check drawn on or payable through a bank in New York, it must AFAIK use the Federal Reserve System. If the check is local, the mail, a courier or a local (ACH) clearinghouse could be utilized.

If you are a FRB member or agent, then you are member or agent of a federal clearinghouse or a federal clearing corporation. If you are dealing with an unredeemed clearinghouse certificate, you're dealing with "(FRB/Casino) House Credit" rather than public money. AFAIK, the Federal Reserve System doesn't make cars, clothes, mobile homes. The Federal Reserve System doesn't even print its own money/currency. The value doesn't come from the bank it goes into or through the bank. The banks are service providers (i.e. accounting, telegraphic, courier and legal services--that's 'bout it).

Also...

Imagine you have a wonderful, wealthy father who has hired a trustee to underwrite your endeavors and to give a guarantee to your payment obligations expressed in lawful money. However, Mr. Stranger crops up and offers you a guarantee too--at a steep price and in the terms of clearinghouse credits. The Mr. Stranger doesn't want to see you prospering and wants you to live a pitiful poor life or to die in a bad way. Naughty-naughty Mr. Stranger knows if you don't express the amount in lawful money, it never triggers the father's guarantee. He also knows and tries to keep it secret that until you redeem the clearinghouse credit for lawful money it wont trigger the father's guarantee. Mr. Stranger knows that you have choice and loves to see you exercise your free will ....

...in the stupidest way possible that helps Mr. Stranger greatly enrich himself. It might be important to note that HJR-192 mentioned dollars* not clearinghouse credits--oooooooooooooooooooooooohhhh sneeekayyyy.

But aren't you glad

someone at least was paying attention?

Does the Bank of Canada print currency? No. Canadian Bank Note Company and BA International Inc. have been primarily invovled in that.

Does the Federal Reserve System issue or print currency? No. the U.S. Bureau of Engraving & Printing does.

Does the Reserve Bank of New Zealand print currency? No. "New Zealand’s polymer banknotes are produced by Note Print Australia Limited in Melbourne".

Does the Bank of Canada even make coins? No. The

Royal Canadian Mint does.

However, banks do print, sell or exchange: checks, money orders, deposit slips or bank drafts.

P.S. Consider that the underwriting activity that a state bank or a federal bank might engage in might only ever be with respect to repossessed assets or with respect to abandoned assets. As in if a bank or a bank holding company [two different things] ever issued its ow

Reply With Quote

Reply With Quote But aren't you glad at least

But aren't you glad at least