-

Member

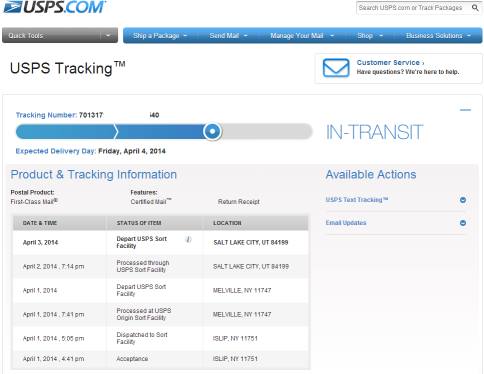

OK the letter is on its way. Screen Shots of Tracking attached

-

3877 Form and Title 15 for the IRS

An addition to seal the witness to any mailing is the use of a Firm Mailing Book of Accountable Mail obtained free from the Post Office.

The Form 3877 Accountable Mail book is the Postal Clerk's inspection of who the mail is addressed to and the count of mailpieces and the postal clerk signs it making the clerk signature and the signature on the Return Receipt Two Witnesses !

Here is a case involving the IRS that the court discusses the Form 3877

https://www.casetext.com/case/welch-...5#.VAE0JPk7uM4

Also, Title 15 is the way to shift the burden of proof onto the IRS's collection process not assessment process. The IRS can make up any numbers and say/do anything they want for the sheer reason they are just debt collectors and are not responsible to know anything. Not responsible for knowing the law and of course they have no first hand personal knowledge and operate on all assumption and presumption aka Prima Facia nothing-ness.

My approach is to conditionally agree with their offer upon proofs of claims of (a list of hundreds of presumptions are true) and this conditional acceptance is supported by an affidavit written in negative averment stating "( I ) Affiant has not seen nor been presented with any material facts or evidence that ..."

For instance:

Affiant has not seen nor been presented with any material facts or evidence that the nature of each deposit was not Special in nature, and believes none exists.

Affiant has not seen nor been presented with any material facts or evidence that it is not the intent of the endorser to redeem the instrument in lawful money per Title 12 §411, and believes none exists.

Affiant has not seen nor been presented with any material facts or evidence that source of the income is not a Foreign Estate, and believes none exits.

etc

Posting Permissions

Posting Permissions

- You may not post new threads

- You may not post replies

- You may not post attachments

- You may not edit your posts

-

Forum Rules