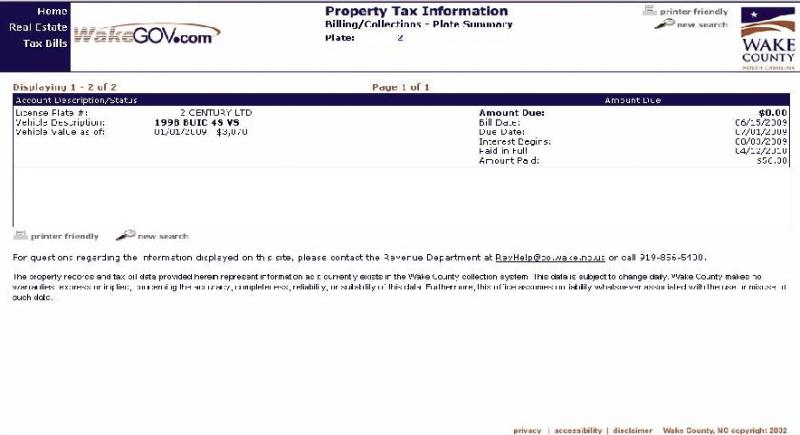

Thanks for adding the graphics. I see that two are associated and gather that the woman discharged the remittance on her Buick and they zeroed out the balance. Did they send her renewal stickers? Or plates?

Thanks for adding the graphics. I see that two are associated and gather that the woman discharged the remittance on her Buick and they zeroed out the balance. Did they send her renewal stickers? Or plates?

That explains it!! In that State the taxes are not interwoven with registration and plates. In Florida and Colorado they are.

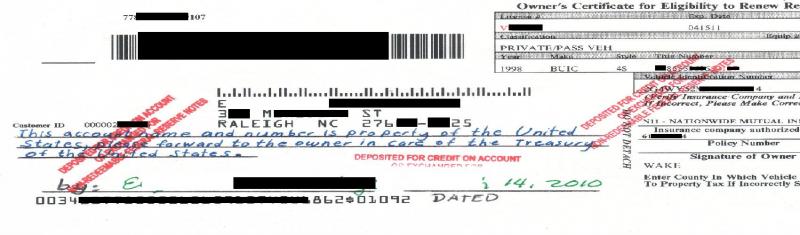

Look at this example of the same thing. This supports that there is no substance in the Treasury Direct Account - or whatever you choose to call it. The taxation was nullified because she owns the car, designated by the Demand for Lawful Money - non-negotiable Federal Reserve Notes in red ink. On her stamp though she designates US Notes in the form of FRNs by saying - non-redeemable (already redeemed).

It probably takes more techniques applied at once to qualify for what I think is "shotgun" style application. What I am saying though is that she tried two things on the remittance, of which only one was actually substantial in law.

Last edited by David Merrill; 03-16-11 at 05:16 PM.

I have played around with some wording on a couple of remittances of trial an error, this does not seem to be the case, I think it has more to do with the part that says "Deposit for credit on Account" and combined with the written language " Deposit to the owner " . So it seems to be the owner(the state where registration took place) is the issuer of the credit to settle the account in the county records.

Additionally the 2 tickets I settled out of court recently, on the second one instead of putting " account name and number is owned by the United States of America" I then put " account name and number is owned by the State of North Carolina " and had the same effect. We are working on something else too based on some information we got from a private group in canada that has has some success just sending the bills to the local Finance Minister to settle, we have determined that position here is somewhere in the birth state where the COLB came from, either the registrar or the chief of justice for the county court where the birth took place. Canadian statutes say the registrar general, but we have uncovered stuff relating to bankruptcy where it is the chief of justice in some states for the county the matter derived from.