Property Taxes are paid by the Registered Owner by and thru an

a priori agreement.

Again what is Property? Property is Right of Use. The Registered Owner has the Right of Use via Agreement. The Trustee has the management of the Right of Use. And the tax is collected on the

RIGHT OF USE.

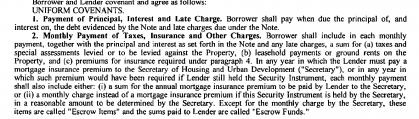

Something tells me if I look at a Deed of Trust I am going to find an agreement within that says the Borrower agrees to pay the Property Taxes.....let me see if I can find one now....

Well now, look at that. It is indeed found within a pre-existing agreement. Wherein that agreement has made known a new term BORROWER and the BORROWER is exactly the same as LEGAL M. NAME or cestui que trust.

And i will wager that the Grantor is lawfully siezed of the estate - therefore the Property never leaves the State. Starting to see why SR#62 is not required to be Public Law?

For those playing catchup at Heinz field, Property is Right of Use. The Deed incorporated by reference a Survey and the Survey is Recorded on a Plat and the Plat is located on a Book of Maps and the Book of Maps is Registered at a book and page WITHIN a Trust Asset Registry known as Register of Deeds or County Clerk and Recorder.

And that agreement does not say the Borrower will repay in Pesos. It says the Borrower will repay with the money of the STATE.

The State is concerned with their Property. So now I ask, what again is Property. If you have not seen it yet. Go to the Top and read again.

But read this first

Plus something tells me the agreement is Probated - Dead Hand - irrevocable Trust Agreement. The Grant cannot be undone.

One thing to consider is what Registry will the Property - and the Agreements that govern the Property - be Registered? Under who's Law Form?

Reply With Quote

Reply With Quote