Doug555,

Like djlamb, I am considering filing 1040 for first time in 4 years. I have been restricting my signature and Redeeming in Lawful Money (RILF) on my paychecks/deposit slips since January 2013, however I have not added the '95a(2)' language (only 12 USC 411). Around that time I sent a Notice and Demand to the US Treasury in DC, however I have not done so with my local bank. I would be shocked if there is NO ONE at my local bank who is not 'in the know' about Redeeming in Lawful Money, but this is possible. In other words, in reviewing the restricted signature with the novation of 12 USC 411 wouldn't the question be raised internally at that bank such as, 'what is this language on the back of these checks?'. Another caveat is that I was very strict in also stamping ATM withdrawals and POS purchases for a long time, but not as much in the past 2 months - intermittently doing so.

Questions:

1) How much does not sending 'Notice and Demand' to my local bank 'hurt me'? As stated, Treasury was notified (recorded it in local Recorder's office), and I have been 100% consistent in novating all deposits into my local bank account. I have all those checks/deposit slips saved as evidence.

Doug: I have saved my PDF records on a Google Drive, and reference that location on my 1040 so they can easily verify my banking demands. Not sending the N&D should not hurt you. IMO, it does not constitute non-hearsay evidence anyways.

IMM: Ok, sigh of relief, somewhat. So scan the evidence and then upload to Google Drive - indicate that link location on 1040 aside the Line 21 offset?

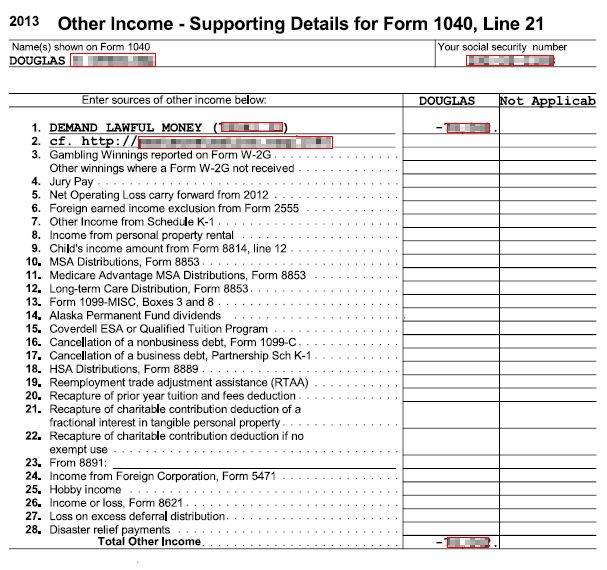

Doug: 1040, Line 21 has "See Attached" on it right after its description. The TaxACT Program then create a separate schedule that has Lines 1 & 2 available for your use. See example below. The Line 21 amount will always have a preceding dash to indicate a negative amount of "Other income", and it should always be greater than your Gross Income amount, because of adding in the "withholding" transactions amounts that were legitimately presumed by the employer to be provided in the default FRN currency.

2) Once the deposits were RILF into my account, is it absolutely necessary to RILF for every withdrawal from that account?

Doug: No. I just do it for "preponderance of evidence" tactic.

IMM: I will make it a point to reinforce this practice going forward.

3) I have been SEVERELY punished in 6702 penalties by Auntie for 2008 for my CTC filing for that year. I feel I will come under greater scrutiny from Auntie if filing 1040 with an offset for RILF. In other words, 'Oh, this guy is trying to "evade his taxes" again. Let's go after him'. Would anyone agree that I am at greater risk for issues with Auntie?

Doug: I was also penalized over past years non/filings. I had to file for all past years and was forced to tender FRNs to "pay" all of that off by establishing an installment plan with the IRS. During that time, I did file 1040s with the lawful money deduction on line 21, and it was honored without repercussions.

IMM: Interesting that STSC posters use the term, "usage fee". Through much research of the Internal Revenue Manual and 6209 document, a poster on LHF discovered that the 6702 'frivolous return' penalty was/is actually recorded in your IMF records as a 'user fee'. There are controls on the software that prevent a VALID 6702 penalty from being entered into the Individual Tax Class 2 module, thus they enter it as a Miscellaneous Penalty into the IMF '55' penalty module. I believe this module was specifically created for 'CTC' filers. Negative 'innovation' for sure.

Regarding my years 2011-2013, I filled out a 'faux return' with only the personal deductions for each year and did not 'owe them any money'. It was either even or a 'refund' due. I suspect if I file these 'late' they will hit me with the late filing penalty, so forget the 'refund'. But this is a small price to pay for getting these returns in order (according to 'them') and moving forward. However, for 2013, I believe I only have a couple of paychecks that were NOT novated (need to check). So for 2013, can I still file RILF for all checks EXCEPT for those couple of paychecks that were not novated?

Doug: YES, definitely. See split-year example here.

4) From the info I have provided, what do I need to do going forward?

Doug: I would set up an installment plan with IRS ASAP to pay off past taxes due. I also tendered several "indorsed bills" but they were never honored... but they also were never returned. Perhaps the

http://usufructremedy.blogspot.com/ approach is worth a try to truly PAY these obligations that are legitimate since you did endorse and use FRNs and thereby incurred their "usage fee" known as the Income Tax.

Then study my website at:

http://1040relief.blogspot.com/ and the

1040 Help comprehensive post here on StSC.

However, there may be BIG CHANGES occurring that will solve your IRS problems - see

http://nesaranews.blogspot.com/2014/...s-now-100.html

IMM: I will consider installment if necessary. As I mentioned in 3), I will need to file and see what the fallout is for 2011-2013, potentially filing with partial or full RILF for 2013 as mentioned above. I will most certainly check out your website and the other link as well.

I have another question that I posed on the CB site that I will pose here at STSC in a new topic, regarding the 'redeeming' language within 12 USC 411.

Though I truly see and believe the law behind RILF and the success as such, I'm still nervous, to say the least. However, I thank you Doug555 and everyone else on this great Forum for your knowledge-sharing and support. I feel less nervous as a result.

I look forward to your responses to the above. Grateful, IMM.

Reply With Quote

Reply With Quote