6 - INCOME

OK let's finish our return & get it filed before the Feds run out of $ and declare the Bankers Holiday. Finish up the INCOME section listing all reported income (or, all the reported income you're comfortable listing). Don't overlook bank interest which will be reported on Form 1099-INT. Investment income will likely show up on Form 1099-DIV. If you paid mortgage interest last year it will be reported on Form 1098, and that means: they presume you paid the interest with Federal Reserve currency (would look odd if you had only $5000 income and paid $11000 in mortgage interest).

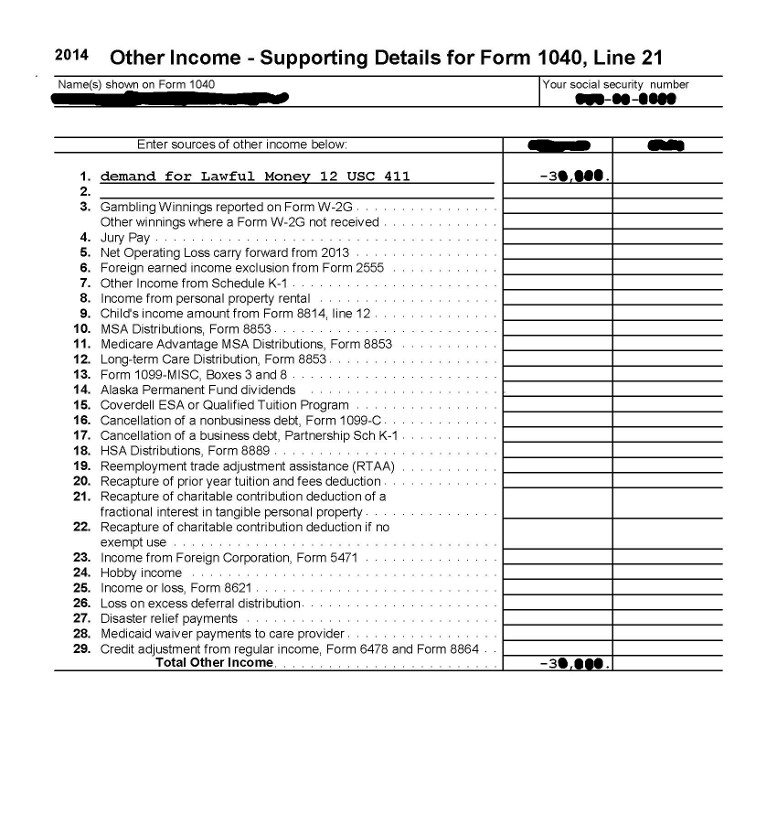

At the end of the section you get to Other Income - Miscellaneous and it's here you enter total redeemed Lawful Money for the year, as a negative amount. A simple total of LM amounts/checks either cashed or deposited. But once again, no more LM than was listed on income lines above. In the description I put: Demand for Lawful Money 12 USC 411. This will create a page titled Other Income - Supporting Details for Form 1040, Line 21 for you to file, like this ...

7 - DEDUCTIONS

Next we're asked questions about Deductions, as shown on the list below. Then you'll be asked if you wish to Itemize or take the Standard Deduction. This year (2014), the standard deduction rises to $6,200 for single & married taxpayers filing separately. The standard deduction is $12,400 for married couples filing jointly and $9,100 for heads of household. We took the standard deduction but if you paid large amounts on medical, charities, interest, etc., then try the Itemized deduction - it may give a better refund.

Educator expenses

Certain business expenses of reservists

Health savings account deduction

Moving expenses

Deductible part of self-employment tax

Self-employed SEP, SIMPLE, qualified plans

Self-employment health insurance deduction

Penalty on early withdrawal of savings

Alimony paid

IRA deduction

Student loan interest deduction

Tuition and fees deduction

Domestic production activities deduction

Other miscellaneous deductions

Standard deduction

Exemption allowance

Itemized deduction - Medical/dental expenses

Itemized deduction - Taxes you paid

Itemized deduction - Interest you paid

Itemized deduction - Gifts to charity

Itemized deduction - Casualty and theft loss

Itemized deduction - Miscellaneous

Itemized deduction - Other miscellaneous

8 - CREDITS

Next section of the Federal Q&A tab are the Credits. The program will ask questions about various credits you might be eligible for, as listed below. We usually get a few of these Credits. The Earned Income Tax Credit (EITC) is available to lower income filers. For example, married filing jointly with an AGI less than $52,427 qualifies for an EITC of up to $6143. The maximum Earned Income Credit for individual filers this year is $496. http://www.irs.gov/Individuals/EITC-...ax-Law-Updates

Illegal aliens can file returns (for the past 3 years) and get the EITC returned as a refund, once they obtain a SSN: http://savingtosuitorsclub.net/showt...et-IRS-refunds

NOTE that as you go through, TaxACT occasionally offers various features & upgrades at additional cost. I answer "No" or "Skip" to these and find the free software does a great job.

Foreign tax credit

Child and dependent care expenses

Education credits

Retirement savings contributions credit

Net premium tax credit

Child tax credit

Residential energy credits

Other credits

Federal income tax withheld

Estimated tax payments/prior year applied

Earned income credit

Additional child tax credit

American opportunity credit

Amount paid with extension

Excess social security and tier I RRTA:

Fuel tax credit

Other payments

Last edited by JohnnyCash; 02-15-15 at 05:17 AM.

9 - TAXES

Next is the Taxes Examiner questions (summarized below) to determine if you're liable for any other odd taxes. Of interest here is the Self-employment tax. If you have income from "self-employment" then you'll owe SS & Medicare taxes on it so it's advantageous to avoid having such "income."

Alternative minimum tax

Excess advance premium tax credit repayment

Self-employment tax

Unreported social security and Medicare tax

Additional tax on qualified plans

Taxes for household employees

Repayment of first-time homebuyer credit

Individual shared responsibility payment

Additional Medicare tax

Net investment income tax

Other taxes

We have some reports of TaxACT not presenting the "Student Status" and "Can you be claimed as a dependent on someone else's return?" questions under the Basic Info tab in the "Personal Info" area. May be a glitch in the program. If you experience this, go Back to the first screen in this section and remove the "Date of Birth" entry; should fix it.

Last edited by JohnnyCash; 02-15-15 at 07:58 PM.

10 - Miscellaneous Examiner

The final Federal Q&A section is Miscellaneous. Most folks have no reason to deal with anything here. But take a look and see if anything applies.

Lump-sum payment of social security benefits

Excess farm loss

2015 estimated tax payments

Underpayment penalty

Reduction of tax attributes due to discharge of indebtedness (Form 982)

Claim for a refund due a deceased person (Form 1310)

Multiple support declaration for claiming a dependent

Release/Revocation of release of claim to an exemption

Injured spouse relief

IRS installment payment plan request

Third party designee

In care of (To have your refund sent in care of another person)

Combat zone

Disaster designation

For clarification, regardless of the LM demand or not on all checks received making up the entire income from Self-Employment minus deductions, Schedule SE is required and one must pay SS and Medicare taxes? The LM demand can not provide any reduction with FICA or Medicare and SS taxes? The LM demand reduction is only for federal income taxes. Also what is your recommendation, "to avoid having such self-employment income"? thanks

Got my state refund today! Don't think I ever got one this early. Did federal return on paper along with redeemed lawful money evidence and waiting on that. State offers a free e-File.gov so I started it but noticed it would not allow a negative amount for Other Income lawful money, so decided to just not include my LM receipts as income. Worked great.

Salsero, once I began redeeming lawful money i realized it changed the nature of my income. It wasn't federal income anymore, it wasn't "self-employment" income anymore and did not need to be included on tax return. Redeeming LM also changed my own nature but that's a whole nother story.