Running the Fed is a great legacy not only for yourself but for your neighbor and children too!

Running the Fed is a great legacy not only for yourself but for your neighbor and children too!

Amen. Three types of Tax Transcripts are available online directly from the IRS http://www.irs.gov/Individuals/Get-Transcript

Return Transcripts - show most line items from your tax return (Form 1040, 1040A or 1040EZ) as it was originally filed, including any accompanying forms and schedules.

Account Transcripts - provide any adjustments either you or we made after you filed your return.

Wage and Income Transcripts - show data from information returns, such as W-2s, 1099s and 1098s, reported to the IRS.

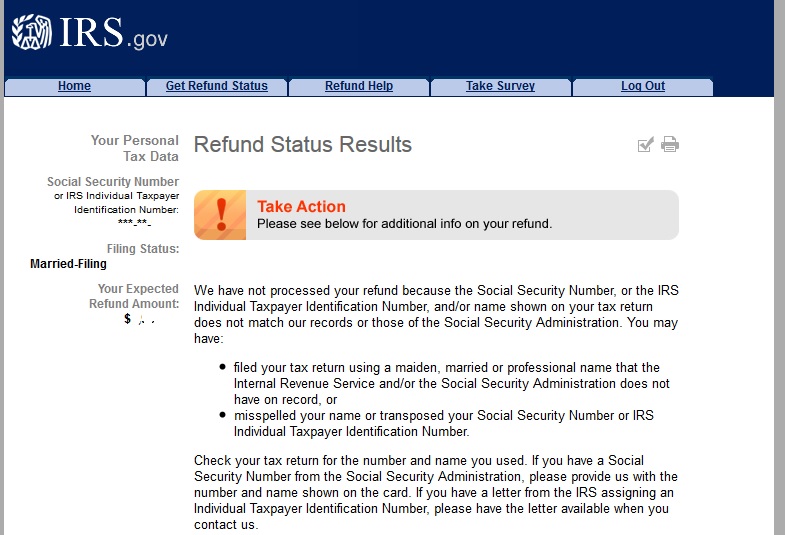

Someone checking on the status of their refund saw this. Not sure why.

Turns out one of the filers has 4 names, First Second Third Fourth, while the tax return has just 3 name slots - First Middle Last. Looks like that was enough to confuse the IRS computer; Name - SSN mismatch.

The blessing is in the hand of the doer. Faith absent deeds is dead.

Lawful Money Trust Website

Divine Mind Community Call - Sundays 8pm EST

ONE man or woman can make a difference!

Reminder that tax returns are due Wednesday, April 15th, 2015.

And chicken fries are back.

Last edited by stoneFree; 03-30-15 at 12:17 AM.

1. Math miscalculations

Use tax software and you won't have errors.

2. Computation errors

see above.

3. Misspelled or different names

The IRS is all about numbers, but words -- specifically names -- are important, too. When the names of a taxpayer, his or her spouse or their children don't match the tax identification number that the Social Security Administration has on record, that difference will cause the IRS to kick out or slow down processing of the tax return.

4. Direct deposit dangers

A wrong account or routing number could cause you to lose your refund entirely.

5. Additional income

Did you have a side job this year? Paid in lawful money? If so, you're golden. As a contractor making lawful money do you really have statutory income even if you received a Form 1099-MISC detailing the extra earnings?

6. Filing status errors

Make sure you choose the correct filing status for your situation. You have 5 options, and each could make a difference in your ultimate tax bill/refund.

7. Social Security number oversights

Your tax ID number is crucial because there are so many transactions -- income statements, savings account interest, retirement plan contributions -- keyed to this number.

8. Complete charitable contributions

9. Signature required

Sign and date your return. The IRS won't process it if it's missing a John Hancock, and that means on e-filed returns, too. Taxpayers filing electronically must sign the return electronically using a personal identification number, or PIN. To verify your identity, you'll have to provide the PIN you used last year or your adjusted gross income from your previous year's tax return.

10. Missing the deadline

Millions of filers put off filing until the very last minute. That's OK as long as your mailed paper return is postmarked by April 15.

Read more: http://www.bankrate.com/finance/taxe...o-avoid-1.aspx

IRS Refund in bitcoins?

Just found out that Turbo Tax filers can get an extra 10% by electing to receive their refund in Amazon gift cards. Jane then converted her gift cards into bitcoins at 3% below market at Purse. Talk about staying out of the Federal Reserve Districts & Cities!

https://medium.com/@PurseIO/10-use-c...n-c6b7182aa1b9

Jane is an accountant in New York. Like most Americans, she’s looking forward to her tax refund. She’s interested in diversifying her portfolio which mostly consists of US equities, commodities, and bonds. This year, she turned her federal tax refund into a bitcoin investment.

Like last year, she filed through Turbo Tax to get an extra 10% by electing to receive Amazon gift cards. She converted her gift cards into bitcoins through Purse patiently and averaged 7% premiums.

While the average premium on Purse for bitcoins is ~20%, there are often orders with lower premiums available for VIP buyers. Jane got verified, accepted Amazon gift cards for her refund, and converted it to bitcoin for 3% below market price.

I am very grateful for all the useful information everyone has posted in this site to help me so far.

Last year I filed demanding lawful money for the latter half of 2013 and there was no problem, in fact they corrected a math mistake on line 32 AGI and sent the 2013 return with this adjustment. This year I filed for a full year 2014 on all paychecks and also 1099 from 401K. The Net AGI turned out to be negative amount because a very small amount of the money withdrawn from the 401K in 2014 was put in there with after tax dollars so it was not included in 1099 from 401k bank. Also since I am not yet 59, I added the 10% tax penalty on line 59 for the 401k dispersal. Other than these numbers, the documentation and schedule for line 21 was the same as my 2013 return. I received the notice over the weekend with absolutely no explanation on what was "frivolous" and I have 1 month to reply. I appreciate any and all comments on what the IRS may be considering as "frivolous" with this 2014 return.

Also, any comments on how a d4l demand could affect the 10% penalty on the 401k early disbursement.

After receiving my refund via direct deposit, I was dreading the letter from IRS telling me that "XYZ" was wrong and I had some explaining to do. The letter from IRS arrived the other day. I quickly opened it to see the bad news. sure enough there was an error in calculations. But the error turned out to be not related to Lawful Money Redemption but some other area. It lowered my calculated refund by about $100. My lawful money return stood!!

The letter said that if I agreed with the calculation to do nothing. I am wondering should I actually send them notice that I agree in full to their calculations, thus cementing the validity of my deduction of Lawful Money?