-

Bank has harassed me about my stamp being used on transactions, here's their letter

I've had an account with First Bank for about 6 months now and have used this stamp on every transaction "Lawful money and full discharge is demanded for all transactions pursuant to 12USC411 and 12USC95a(2).

A couple of weeks ago, my bank First Bank had a branch manager call me and tell me their "compliance department" said that I cannot use my stamp. They threatened me over the phone that they would close my account if I kept using the stamp. I'll note with you all that I was overusing the stamp by stamping that on the back of all received checks (which is good), stamping this on the front of all checks I wrote out (bad, and overkill I found out later), and also stamping this on deposit slips as well as withdrawal slips. I now only use the stamp on the back of received checks, on deposit slips and withdrawal slips.

They threatened to close my account and I told them that I do not accept their offer to close my account immediately (while I still had checks outstanding), that Title 12 applies to their bank, and that they would have no other reason to close my account other than violating Title 12 of the United States Code and possibly discrimination. I told them that they do not get to choose which federal laws from Title 12 apply to them, and that they are legally bound to comply. I told them I would stop stamping it on checks that I write, but they insisted I not use it at all, this is where the problem is.

Fast forward two weeks to now. I've stopped using them but left a small balance in my account, as I also use WF who doesn't give me grief about my restrictive endorsement. However, I'm not ready to give up a fight with First Bank and I'm not going to bow down and be among the "sheeple." I just received my state and federal tax refund checks with my first quarter of redeeming lawful money, it was rewarding and now I'm not backing down for any banker.

I am in Denver, Colorado, and I'd love advice from you fellow patriots on how I should approach this. Denver Sheriff? Centennial Sheriff? Colorado Attorney General? Colorado Department of Regulatory Agencies Division of Banking? Who should I get involved, and what are some of the points I should hit them back with in a certified, "non-negotiable" letter "without recourse"? Who do I need to involve, at what level to CC a letter to to get this law enforced, and to teach this banker the federal law that applies to her line of work?

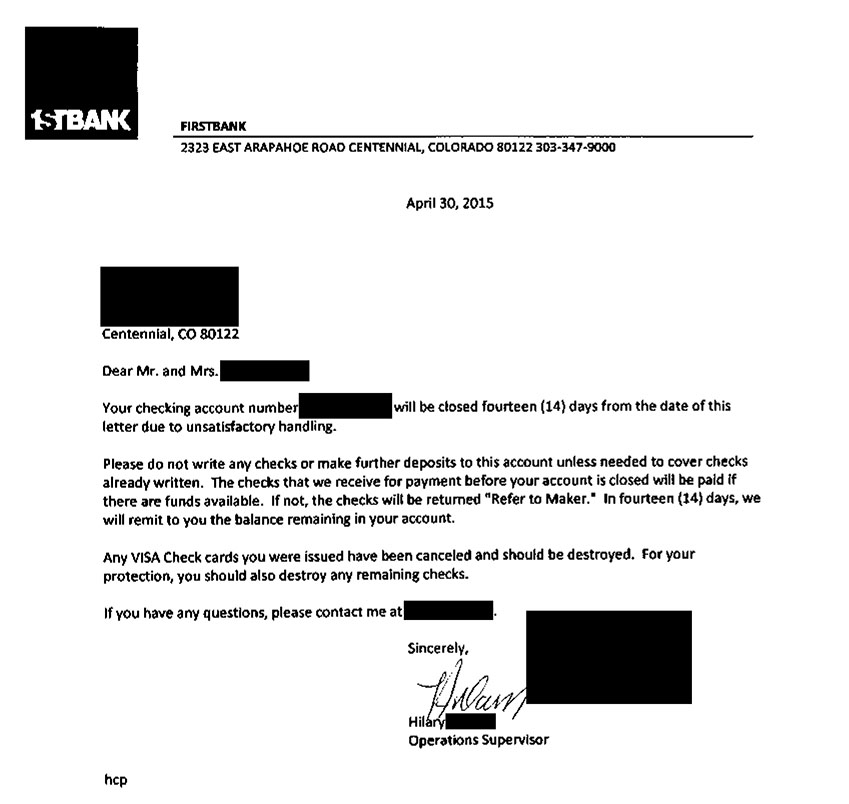

Furthermore, this letter from Hilary the banker is pathetic, citing my reason for their closure of my account as "unsatisfactory handling." She won't cite her non-compliance with federal law as reason for closing my account, maybe that's the first point I need to make in a letter back to her.

I also let her know she's practicing law without a license and that I need to speak to the legal department, not a compliance department, she never did this and has instead sent me this letter.

The letter from the "operations supervisor" at my nearest branch is attached. Thanks in advance for any advice and God bless you all.

Last edited by teamsnowden; 05-05-15 at 12:21 AM.

Posting Permissions

Posting Permissions

- You may not post new threads

- You may not post replies

- You may not post attachments

- You may not edit your posts

-

Forum Rules

Reply With Quote

Reply With Quote