There are significant points made earlier in this thread. Can you prove that the Assessor is using FRNs as the denomination? Likely he specifying that you pay in dollars. Perhaps you are mistaking the assessor for the US Department of the Treasury? The Assessor might make demand in dollars. The public policy is wide open to allow FRNs or for you to pay with lawful money. If you want the bill to be specifically in lawful money you can write the amount in words followed by "U.S. dollars lawful money" or the like. Could it be that neither your lack nor abundance of U.S. notes would necessarily caused by the Assessor?

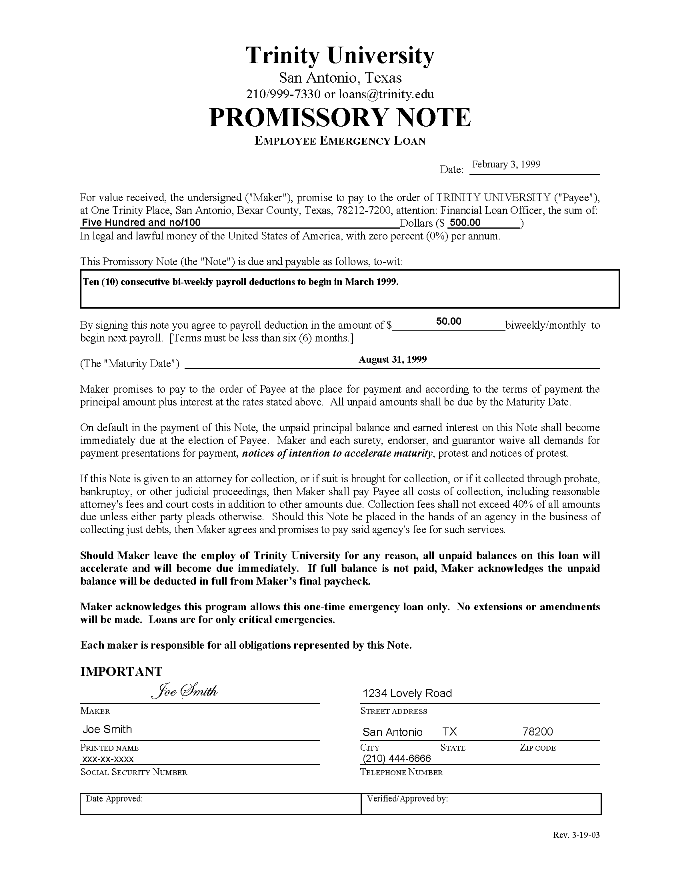

If you sign up for a system of private law or deadhand corporate law, then the laws of the "nation" might not necessarily apply or even if they do the private law might apply moreso. Promissory notes for mortgages and student loans AFAIK are most always denominated in "lawful money of the United States of America". Thusly, lawful money *is* in circulation.

Reply With Quote

Reply With Quote