I am confused on why that would not be filed. I have copies of everything that was sent. Can this be fixed without resubmitting additional gifts?

By way of introduction, sometimes I come across a direct communication that is edifying to the entire brain trust. So I sanitize which suitor is involved and comment by broadcast. As teacher and student this communication creates for everybody.

Below, the suitor began a partial redemption tax year return process. The federal refund was prompt as expected. The State Department of Revenue made no frivolous threats or comments but began paper billing for $63 and counting interest. Therefore as we set up his evidence repository he decided that a $70 "gift" to the State Department of Revenue would cover the tax liability. This technique has worked before with other suitors.

One method of handling this is to wait for the $70 receipt for the "gift" and then use that against the "tax liability". However there is no evidence but the suitor's say-so on the Clerk Instruction because the US clerk of court failed to put both the $70 cash copies and the $46 cash copies on the PACER publication. If the new suitor does not mind I will show you Doc 1 opening the Miscellaneous Case and the docket report too, verifying acceptance of the $46 filing fee.

The State has sent another bill.

____________________________

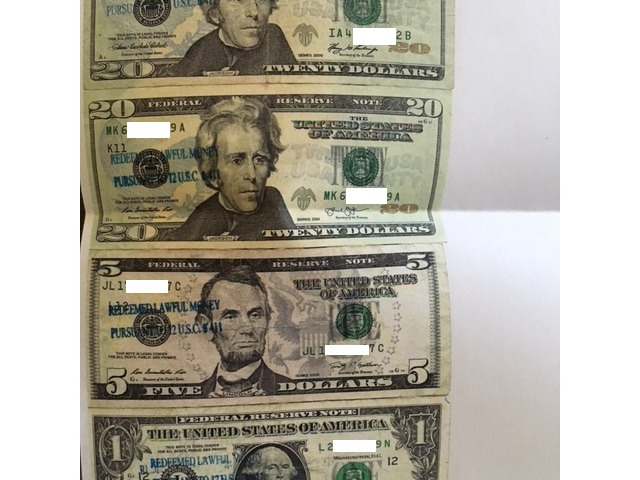

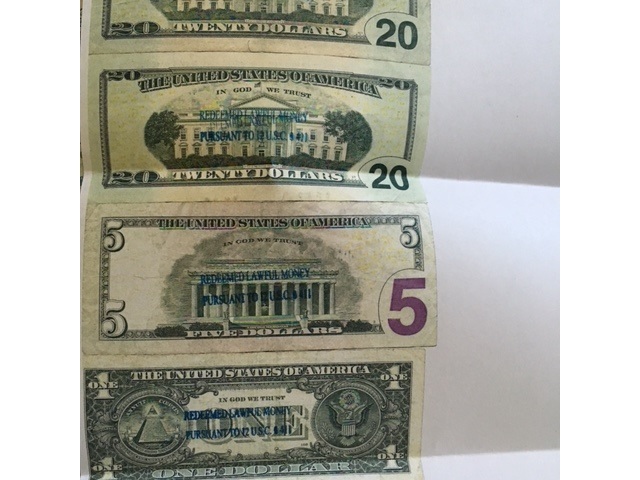

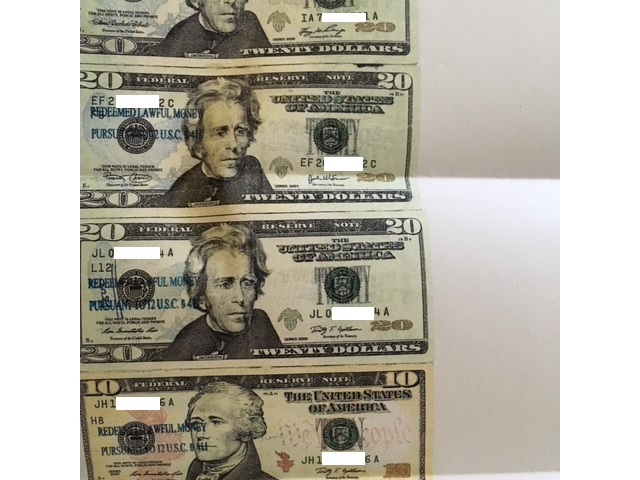

That is very interesting. Technically/legally the clerk of court may have had problems with you marking the front of the bills. But then on that stream of thought, the clerk would not have accepted the $46. So there is a law somewhere, I think in Title 31 saying that a clerk should not publish/counterfeit currency unless it is 70%/30% altered in size but that is obsolete because of graphics, and all the counterfeiting prevention in newer bills. Back up to the first reasoning. By putting your Demand on the front of the bills you have made a presumption of authority called "cancellation". You have redeemed the note. This means that the clerk of court cannot pass that debt on. Nobody cares because everybody likes to be paid but since the clerk is likely an attorney or is working closely with federal judge/attorneys, and they don't like what you are doing any way they probably opted not to show your authority off on PACER.

The same authority is sometimes shown by placing a postage stamp (lawful money) on a document and signing through it - cancelling it by authority. Without authority in other words, one might be charged with defacing money. The perspective is whether a rounddate from the postman or a scribbling signature by the USPS patron, the postage stamp has been redeemed. The currency was "sunk" into the action of moving or delivering the letter, in most cases with the rounddate by the USPS clerk (of court).

Otherwise I will presume that the clerk of court spoke with the State Attorney and they decided to not publish evidence you paid the Department of Revenue any gift at all, which is reasonable to presume was to get them off your back. So the State has accepted your gift and not applied it to the tax liability at all.

I will help you prepare a new clerk instruction. We might demand a receipt from the State Department of Revenue? But you did say it was a gift. There are actually patriotic people who will or otherwise donate gifts to States and the Federal Government too. - Even directly through the Departments of Revenue and IRS, believe it or not. But this new bill needs to be R4C timely. So I suggest that I help form the verbiage to reflect an apology for marking the front of the bills with your demand and this time you specify that your "gift" is intended to satisfy their imagined tax liability. Please be sure to send a receipt reflecting that there is no longer a tax liability with the State Department of Revenue.

The Clerk Instruction might actually show the second payment of $70, or we can pursue getting the $70 already paid on the tax account to discharge the liability.

This is why revenue matters are admiralty - both because of the international nature of the DOLLAR and central banking, as well as the debt notes being derived from a heritage of bottomry - later called insurance. An unnamed insurance can be passed around with debt as its value, among endorsing debtors. We are different by redeeming but your bills really open a can of worms when viewed by an educated federal judge. You compelled the clerk of court to redeem the notes upon receipt by marking them on the front side. This is really worth pondering carefully among the brain trust.

This is why the clerk of court (may have) actually "spent" the notes filing and publishing your Miscellaneous Case evidence repository. Now the notes are spent and should not be passed on. They should be burned after returning them to the Treasury for accounting purposes.

This is amazing! Thank you for walking me through this part of the Journey!

From:

Sent: Wednesday, March 02, 2016 10:01 AM

To: David Merrill

Subject: Re: state return letters

David,

I did send the $70 cash to the state with a copy of the $46 I used to file and the $46 cash to the court with the copy of the $70 gift I sent to the state. I had those copies in the envelopes with the other documents to be filed. I do not know why they didn't include it on PACER. I am sending a picture of what I sent along with the actual money(redeemed in lawful money).

I am confused on why that would not be filed. I have copies of everything that was sent. Can this be fixed without resubmitting additional gifts?

On Mar 2, 2016, at 11:17 AM, David Merrill < > wrote:

View the Attachments please.

As I recall I suggested that you pay this and deal with the State next year, when you have a full redemption tax year. So I presume you included $70 cash (gift) marked "redeemed lawful money" somehow. The copies of the cash - both the $46 and the $70 do not show up on the PACER report attached.

Did you include copies of the $70 in bills in the Clerk Instruction mailing; copies should have been on all copies, including the original to the Dept of Revenue in the State. This looks like the State Attorneys are accepting your gift but telling you to make better records if you want them to apply it to the tax liability.

I will help you get this more precisely into the Record, both with the Clerk Instruction and the cash copies into the PACER publication. This may be costing another $70 though. You specify it as a "gift" and they obviously did not apply it to the tax liability there in the State.

Another possibility is that you did not include the $70, and that explains everything. Sometimes the instructions over the phone are misunderstood by a new suitor, or they just deviate from what we spoke of. Read the Clerk Instruction attached carefully and email me back please.

From:

Sent: Wednesday, March 02, 2016 6:40 AM

To: David Merrill

Subject: Re: state return letters

David,

I received this letter from the State Department of Revenue. What is the best course of action? R4C? I have not heard back from the court. I can only assume that this letter was sent after they received my response with $70 gift. What do you think?

Thanks for your help!

Reply With Quote

Reply With Quote