-

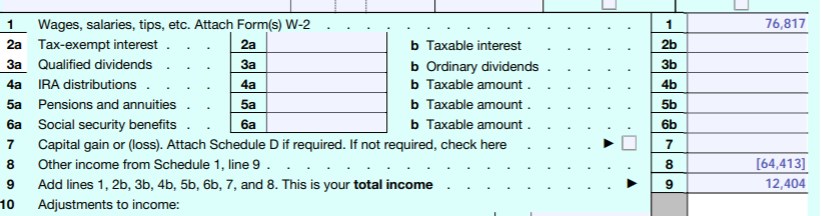

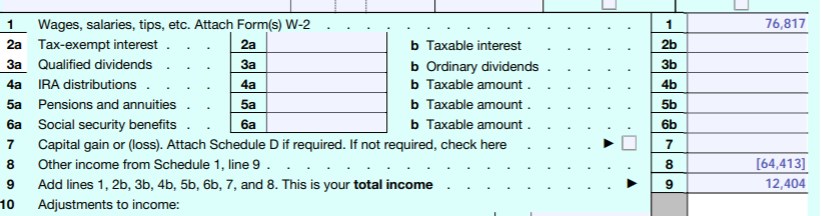

In your federal Form-1040 filing example, it could be problematic to subtract the entire gross pay [76817] as redeemed lawful money (assuming this is a W-2 employee). For the simple fact the employee would not have the full $76817 in checks to redeem. At a minimum, deductions for Medicare & Social Security would be withheld from the paycheck before the worker could make a demand.

Seems safer to use the total of redeemed checks for the year [say $64413] as shown below. This would result in $12404 of income yet still no taxable income and no federal income tax due.

I guess you could make the argument of "redeemed" - that Notice & Demand to US Treasury for all transactions demanded in lawful money supersedes the W4 employment contract of the "employee" working for "employer". But I'm not so sure.

Posting Permissions

Posting Permissions

- You may not post new threads

- You may not post replies

- You may not post attachments

- You may not edit your posts

-

Forum Rules

Reply With Quote

Reply With Quote