I knew this would become very interesting!

Subject: Re: inherent vice

Hey Davis, Do you believe ripple will be used as the digital currency and how much do you think the value could be if/when it gets formally announced?

________________________________________

I prefix this with my hypothesis that The Calculus is a specific guess, designed to be more accurate than the last guess, guessed at an infinite number of times. This is possible because time does not exist within the quanta. A lecture by Keith DEVLIN, author of The Math Gene introduced me to the Calculus as "pure magic". He also laughed out loud when I showed him that I knew Fermat's Last Theorem is connected to the Five Cube Sum Number Locks and is integral to solving for Fast RSA Factoring Algorithms - which are only manageable with superconductive quantum computers.

My point is that my mind works in transforms, one of which is proven correct by an expert, but transforms that cannot be simulated outside the scope of the timeless quanta, where memory resides in the Q. A flexibility (plasticity) in capacitance.

Neurosurgeon Richard RESTAK concludes his The Great Courses lecture series with nonsense, to the material scientist. "What could be more important than getting in touch with your emotional memories?" Having written over 80 books and peer-reviewed papers Richard is arguably the foremost teaching expert about the brain. Yet, I wonder how quickly he would own up to that quote over the dinner table - if only because how much linear time (language) it would take to explain even though it is a plain fact.

That is what I meant in this morning's broadcast (below). It does not matter how you understand the left brain details. I am after how you feel about it, even if you deleted the broadcast unread.

Hey David, Do you believe ripple will be used as the digital currency and how much do you think the value could be if/when it gets formally announced?

I feel that I have pointed out that SDR's will be, and have been used for currency since the mid-'70's. The shift to reserves for the CBDC occurred on June 5, 2023 with suspension of the national debt, which is an international banking (central banking) transaction building interest. The escalation in loans, and therefore interest began when bankers (the Fed and all endorsers as "member banks") began to see the CBDC on the horizon. But the docket report shows the flurry of movement on the Ripple case began on the 13th. A week later (docket report attached), beginning with Motion for Summary Judgment by Ripple (Doc 824 also attached).

That may shorten the time to deliver an intelligible answer. The real material in money is what backs it? People would be crazy to think that Blockchain styled security measures can possibly back currency, or have any value at all! Like I pointed out, the Fast RSA Factoring Algorithm is already available.

I will pigeonhole your question the best I can into a brain trust lesson about conditioning. Which is the more common reason that I remove the suitor's name/id from the Reply to All. In case it might be embarrassing.

I have never heard anybody else, besides me saying just search out

"Fed Assets Current". The link practically explains itself:

https://www.federalreserve.gov/data/...mm/current.htm

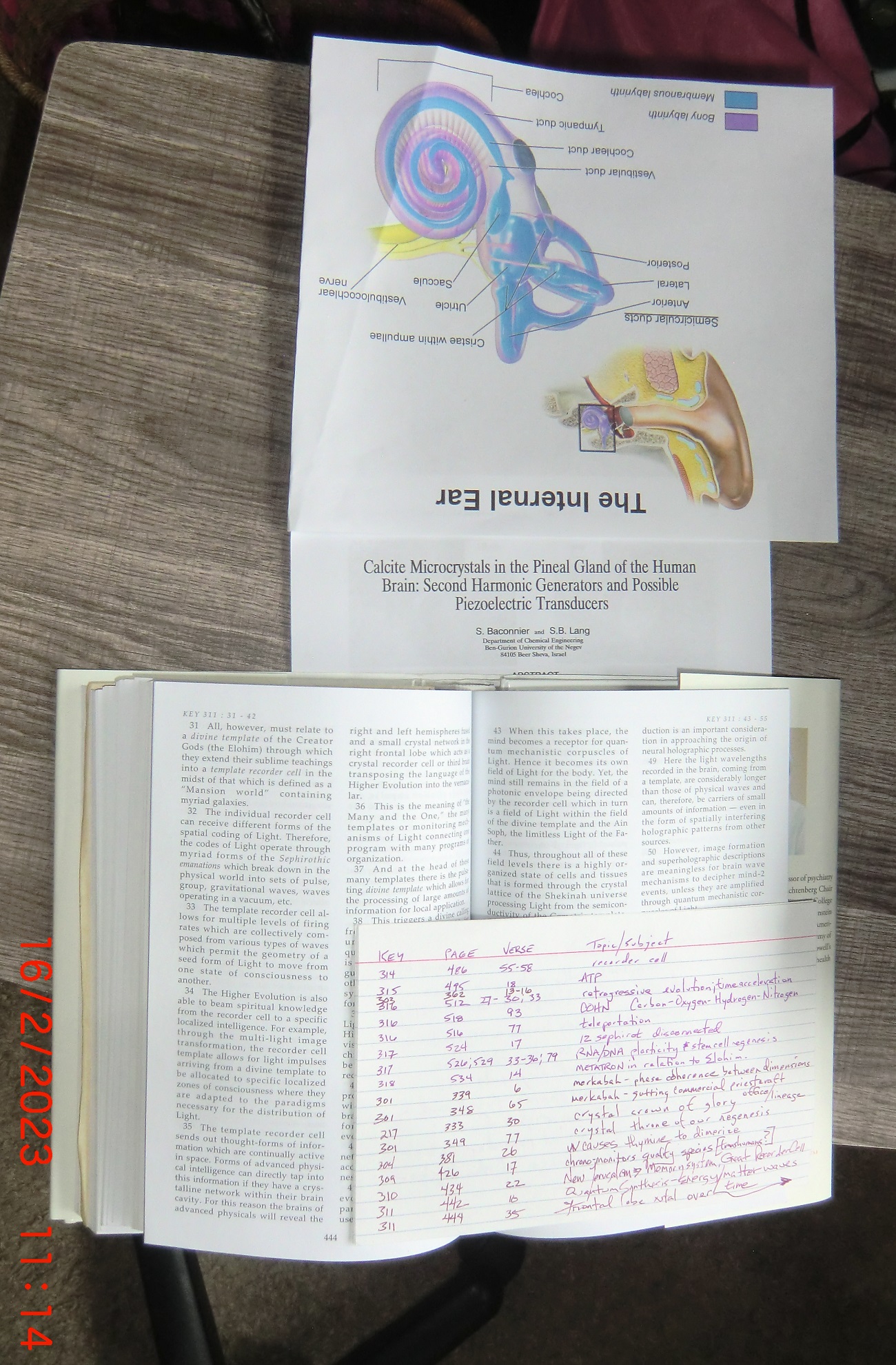

So albeit I am not a mind reader I can postulate and project from how I used to think. The inherent vice is degradation of thought process by "dumbing down" - mainly pineal gland injury (calcification). This makes it very difficult to understand how gold is fine white powder. The value of gold metal is merely a tranche - an intermediate step toward value. A small sliver of a gold coin will produce a sizeable pile of real gold.

The manifestation of the pineal gland injury is confusion, being detached from divine orchestrations and heavenly symphony. The mulberry like hydroxyapatite concretions (calcification) function like a Faraday shield dampening signals to the myeloconia. (article attached) Furthermore I have located the likely much more developed since, crystal recorder cell as of 2011:

The symptom of the manifestation is that you might feel macroeconomics is more complicated that Googling the Federal Reserve Assets Report, if you want to know what is backing the Federal Reserve Note and the Federal Reserve Bank Note. Mostly though, you might keep thinking like you are part of that absurdity - now gone fly away in a blur of lending and interest. You are Redeemed, I assure you. It is only the delusion programmed into you that you are undeserving.

Remember that the religion Jesus chose was to be dunked in the Jordan River by John the Baptist, and be cleansed of his sins. Without guilt/fear Jesus was able to gain clear vision about his Messianic identity.

The question assumes that Ripple is a digital currency that is somehow interdependent with the Federal Reserve. The Fed is the US central bank. So that would be the "announcement"? That the Fed is using Ripple for its assets? No need. My definition for the SDR is the measure of social conditioning to blindly endorse the private credit from the local central bank. But there is a catch to my assertion.

People writing articles on the Internet are for the most part unredeemed endorsers. They will and have adopted the notion that this is much more complicated that Google "Fed Assets Current". So they will try cramming what they think they understand into the echo chamber, sounding like they know what they talk about in such a manner that it will bounce around for decades. So it could become a thing, if enough people believe the Fed has adopted Ripple cybercurrency for the reserves.

A good example is my conditioning that Congress is to blame for pegging the face value of US notes to Fed notes. Congress doesn't do that, specifically the grocer (people) do that. For the longest time it seemed a matter of Laws of Congress but I could not find any such law. It is common law that is left to the people. If the grocer does not want to calculate the value of a US note he will just accept it at the Fed note value on its face.

So if enough people believe that Ripple is the new CBDC Cybercurrency in operation they will likely find plenty of confirmation from the pundits wanting to remain popular. It still seems easier and simpler to Google "Fed Assets Current".

On Jul 21, 2023, at 11:13 AM, David Merrill <> wrote:

Greetings Suitors;

Just search for "Fed Assets Current". With the June 5th suspension of the debt ceiling we can see what the liquidation of the SDR (Footnote 2) shapes for the future: