Attachment 2189

Thanks for posting this stamp, which I know is what David has always recommended and used, and which is working, but sometimes is rejected as a "restrictive endorsement".

Here is WHY I do NOT use this stamp.

Technically, 12 USC 411 states that one may only

demand lawful money, after which the system is presumed to have the duty to "redeem" it into lawful money.

12 USC 411 does

not say that

we actually do the

redeeming. That is not our responsibility, IMO. That is the system's job.

Therefore, the wording in this stamp is

presumptuous. It is stating something that may not have occurred yet.

We cannot

technically state, at the time that we stamp our instrument, that it is, at that instant, "

Redeemed Lawful Money".

Also, look at it this way.

If it already has been redeemed as it says on the stamp, then the system would then NOT have to redeem that amount on that instrument, and the person stating that it was

already redeemed could be accused of

fraud-in-the-factum.

So, this is an

important technicality that IMO should be thoroughly discussed here, and

resolved ASAP.

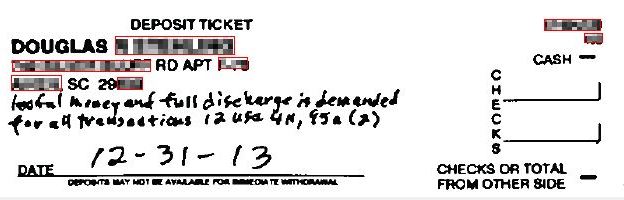

This is why I use this

handwritten demand below:

Reply With Quote

Reply With Quote