Publius commented:

We have plenty of evidence but there is an element that prevents enough details for a proof over cyberspace. A comprehensive evidence package is not available. There are suitors who are tax preparers and even bankers/licensed tax preparers but they like to filter their experiences sanitized, even with other suitors. If a suitor broadcasts details, fine; that is why we call it a brain trust. We trust each other. If a suitor sends something interesting to me though, I will sanitize it and broadcast it with my commentary. If it is a success story about the IRS though, I will send the sanitized rendition and comment back to the suitor alone for approval before I broadcast it to the brain trust.

We do not have a lot of sanitized success stories because I just do not bother with the sanitizing process unless a better example comes along and since they are sanitized, they cannot be verified and you will just have to believe me... So it gets so no better success stories come along until somebody is willing to give their address and SSN over the Internet.

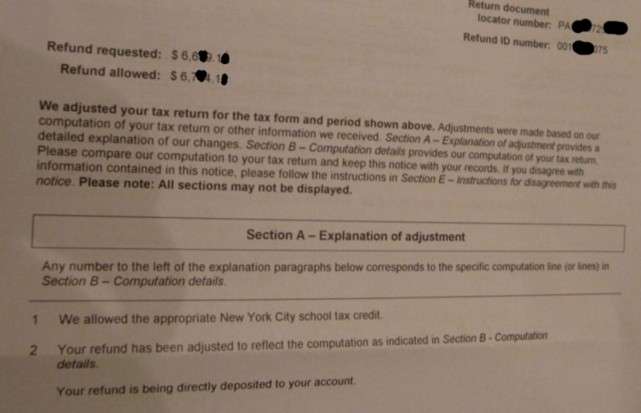

One of my favorites is this one where NY (METRO's Finest) pondered the state tax return carefully enough to add on the $125 School Tax Credit but did not flag that there are thousands of $$$ of withholdings on zero taxable income!

If you want to look at those figures awhile, you might be able to convince yourself I am not lying.

However on Quatloos I am moderated and forbidden to show examples like this because,

If you are going to show examples boasting that you can break the law, they have to be verifiable!

I worked carefully with the suitor and have shown you exactly what he is comfortable with me showing you.

Reply With Quote

Reply With Quote