Dont know why April 15th is of any big deal here?

I showed you, that was the date set in 1861 by Abraham LINCOLN.

You Dave act as though this 37th congress session is a big deal.

Yes. In the grand scheme of things America in a civil war enabling fiat is a big deal.

I dont care what day they picked as a deadline to file as it doesnt matter. The matter and point was a majority of the American population didnt file until 1940.

I already presumed that you are correct but you still have made no effort to convince me. I am not calling you a liar, just saying that you do not meet any rules of evidence with that assertion. I already agreed that it sounds right according to HITLER coming into power and forming a war chest for WWII.

And your previous post about shaving off twenty years and something about 4 other years.................what point are you trying to make here?

I made my point above. I would copy and paste my post from above simply to avoid your attorney-like trolling. You want me to paraphrase in a manner that is easier to debunk? No, thank you.

Your premise is that the mere use or having fiat in your pocket imposes the income tax by your very own words!

Well.................what does the reserve bank charter of 20 years have to do with anything?

I think you are joindering Allodial into my posts, but I don't think that is what he is saying. What I get is that as we form the New Trust of FDR's by endorsing the private credit with our salary checks we become the enforcement arm against ourselves. We become our own Taxpayer/IRS Agents. That is what I got from Allodial's posts. The IRS is just keeping the Record of our agreements (1040 Form).

The private federal reserve doesnt and cannot impose any taxes on Americans like the Social Security act does. Nor does the reserve act classify occupations as "employment" which the definition comes from Title 5.

I have the Fed Act and USC Title 5 handy but will leave it to you to support that for us.

So which is it Mr. Merrill?

Does or does not the reserve act with its "supposed" hidden fiat imposition cause taxation or not?....you cant have it both ways......or can you?

I redeem lawful money. So your point is moot. I demand cash. I teach people how to redeem lawful money and they get full refunds of their withholdings and after careful contemplation by the IRS agents and IRS attorneys. The one more significant example was outstanding! Just recently the IRS backed off with this letter.

You know over at another site a quatloosers has chimed in saying you are legally a nutcase. Even showed the document stating you cannot be legally held accountable. basically it says nobody should take you word for anything. And from the looks of this you are waffling back and forth much like Hendrickson did and still does when confronted with facts that cause his theory to spiral down in a flaming crash.

I think you are fabricating that, my waffling. I edited my harsh comments about Quatlosers and their pathetic addiction on ridicule, before I read your post far enough to get that last paragraph. You make my point about that, in my opinion. You are a bored Quatloser. Like pointed out before by somebody else here I was moderated to the point that I became bored. Having to wait for my kind of fun, that threw off the timing so I was simply no longer entertained. If you need me back so badly then have Wserra lift my moderated status.

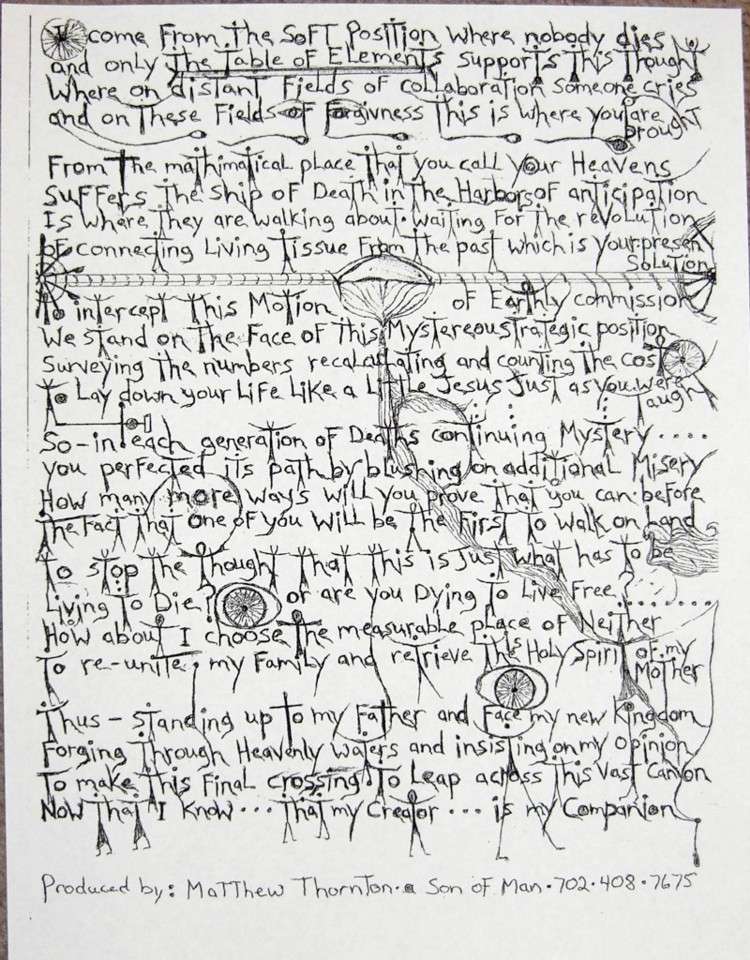

Your attack has not yet arisen to anything I will defend other than that the psychological evaluation of which you speak was by a State sock-puppet who was lying. I recorded the interview and put that sound track in a video that I share openly as a great lesson about record-forming and consent. The interview, according to fact never happened because he could not get me to sign the consent form. I am not going to buy into your distraction and trolling further than for you to Click Here.

Reply With Quote

Reply With Quote