Originally Posted by

Hugh Mannity

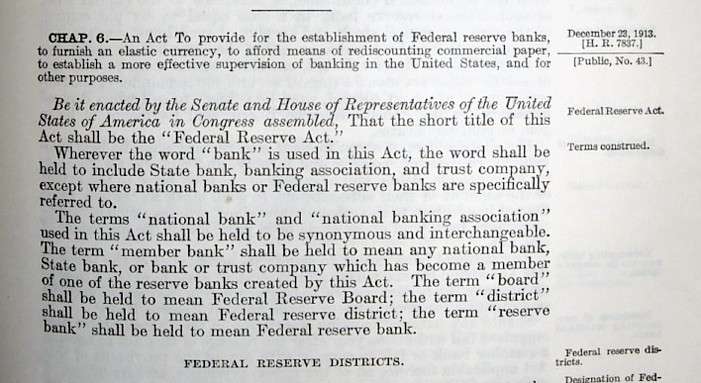

The bank manager informs me they do not allow restricted endorsement (even after I told him I simply want to correct my signature card). When I specified that the law allows me to redeem lawful money at any federal reserve bank, he states their bank is not a federal reserve bank. They are insured through the FDIC - does that make them a 'federal reserve bank'?

With going to a different bank to open an account, should I just sign the signature card (First Middle, etc.), without even mentioning 'lawful money redemption'? Perhaps they won't notice? I'm hoping I can find a bank that will comply!

Reply With Quote

Reply With Quote