Originally Posted by

DebasedCurrency

I stopped by my Credit Union to put the restricted endorsement on my signature card. The branch manager wanted to know why I was requesting such an unusual thing, so I told her. Naturally, she had absolutely NO idea what I was talking about. Befuddled, she wanted the request in writing. I told her I would comply with that.

The following is the actual text of the letter that I drafted up. It is written by hand. It is yet to be sent, but when I do send it, it's going by way of certified mail with return reciept.

---------------------------------------------------------------------------------------------------------------------------------------------

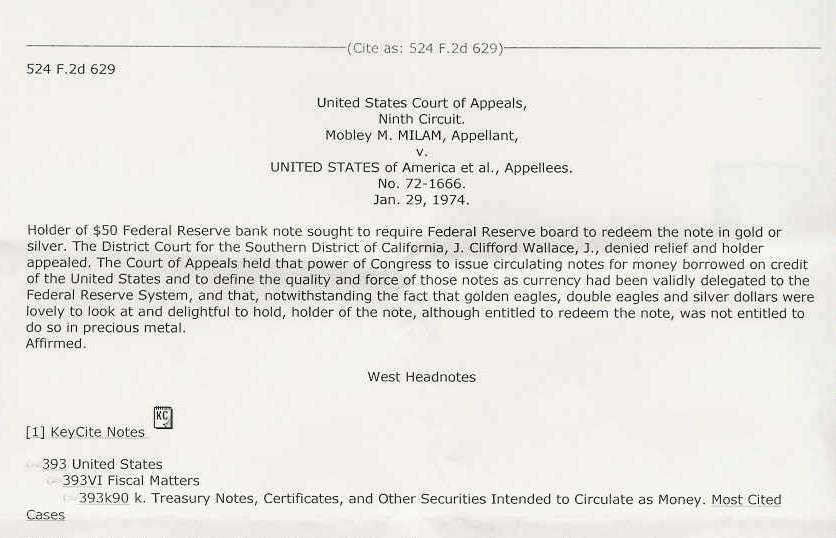

I, The Suitor, DBA THE SUITOR, am hereby this letter making my official demand that all withdrawals and deposits, by whatever means, for the accounts opened under my person, are to be redeemed for lawful money pursuant to Title 12 U.S.C. subsection 411. My account signature card needs to reflect the new restricted endorsement. I do not endorse private credit from the Federal Reserve.

THE SUITOR

Account #: XXXXXXXXXX

In good faith,

The Suitor's true name

The Suitor's address (-zip)

Phone #

Email Address

Signed, and Dated,

My Signature, & the date it was signed (NOTARIZED IN THE STATE OF NEW YORK)

---------------------------------------------------------------------------------------------------------------------------------------------

After it was notarized, I stopped by the courthouse to open an evidence repository, but was unsuccesful. None of the clerks had any idea what I was talking about. Apparently opening an evidence repository is extremely uncommon.

Before I send this letter to the Credit Union, I would like to first enter it into an evidence repository, but I need help on this part.

Am I doing this all correctly? I feel like such a novice. I think the following adage is appropriate: "We only learn new things when we step outside of our comfort zone"

Reply With Quote

Reply With Quote

...There is a District Court across the river; I was in the wrong Court, making an incorrect demand.

...There is a District Court across the river; I was in the wrong Court, making an incorrect demand.