-

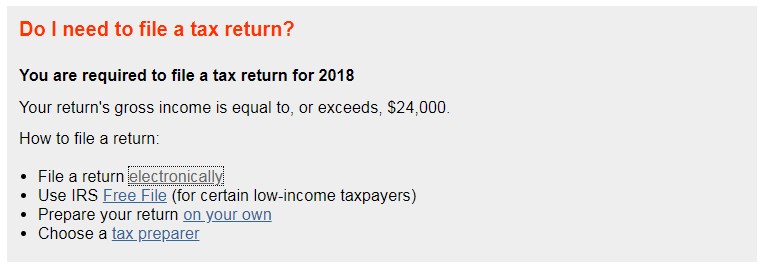

Good point. The IRS.gov site has a Do I Need To File questionnaire where you can find out if you're required to file. Generally, a single filer with less than $12,000 in gross income is not required to file. Or less than $24,000 for married filing jointly.

But what is gross income? Our experience indicates it is federal income; Federal Reserve income. You may want to tally up all the presumptions of federal income from those info reports to see if you're required to file. They're typically found in Box 1 of the Form W-2, or Box 7 of the Form 1099-MISC.

Even if not required to file you may want to anyway. For example, to obtain a refund of FITW (Box 2 - Federal Income Tax Withheld).

Standard disclaimer: Nothing I say is legal or tax advice.

Tags for this Thread

Posting Permissions

Posting Permissions

- You may not post new threads

- You may not post replies

- You may not post attachments

- You may not edit your posts

-

Forum Rules

Reply With Quote

Reply With Quote