MENDOZA made final judgment on March 25th - summary judgment for the Defendant, UNITED STATES OF AMERICA. At least on Schlabach's 2013 claim.

Document 25

Document 26

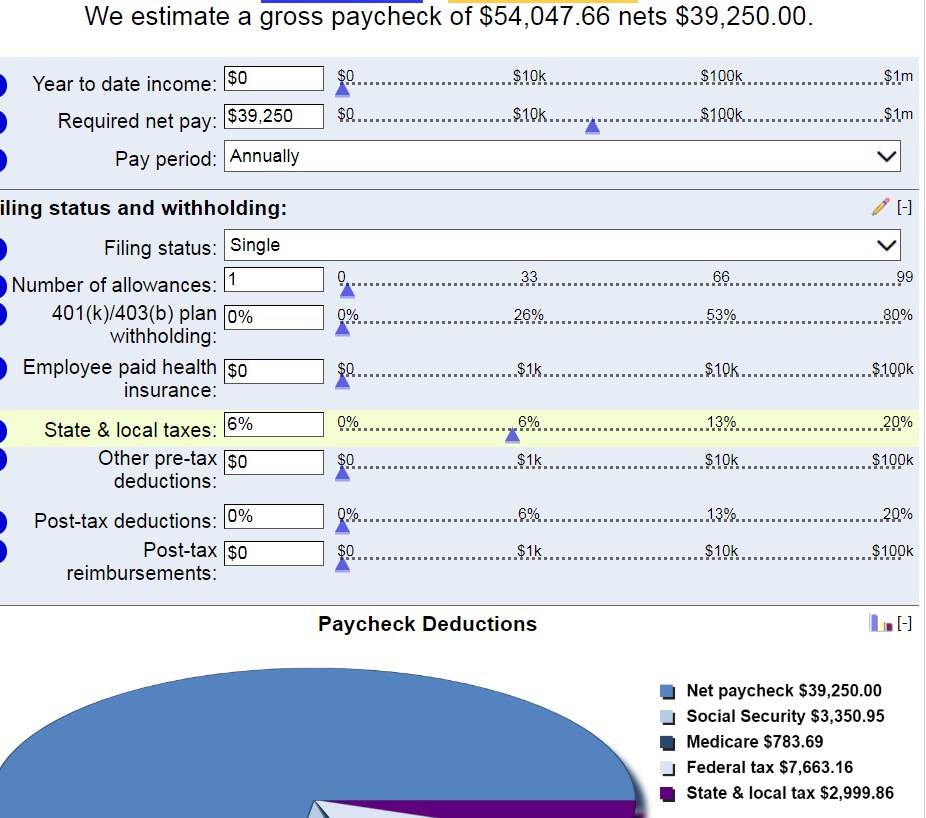

I see more problems with SCHLABACH's claim. From page 5:It's impossible for an employee grossing $54,084 to have $54,084 in net pay to redeem in lawful money. Schlabach's net pay (actual paycheck amounts) after SS, Medicare, FITW, & State tax deductions would be more in the neighborhood of $36,250. His self-assessment is substantially incorrect.In his Form 1040, Schlabach claimed $54,084 in “[w]ages, salaries, tips, etc.” from IRS Form W-2; subtracted $54,084 in “[o]ther income” he purported to have “REDEEMED IN LAWFUL MONEY PER 12 U.S.C. 411 ab initio”; then claimed zero dollars in “total income,” “adjusted gross income,” “taxable income,” and tax liability.

And what is “REDEEMED IN LAWFUL MONEY PER 12 U.S.C. 411 ab initio” From the beginning? Beginning of when? Where are the copies of redeemed LM checks? Signature card? marked up copy of Notice & Demand? I see none in this claim. It's one thing to say you're redeeming lawful money and quite another to actually do it and back it up with proof. This is rule #2 of the the lesson plan - keep the record. SCHLABACH claim fails rules of evidence.

Reply With Quote

Reply With Quote