-

Senior Member

No enforced compliance

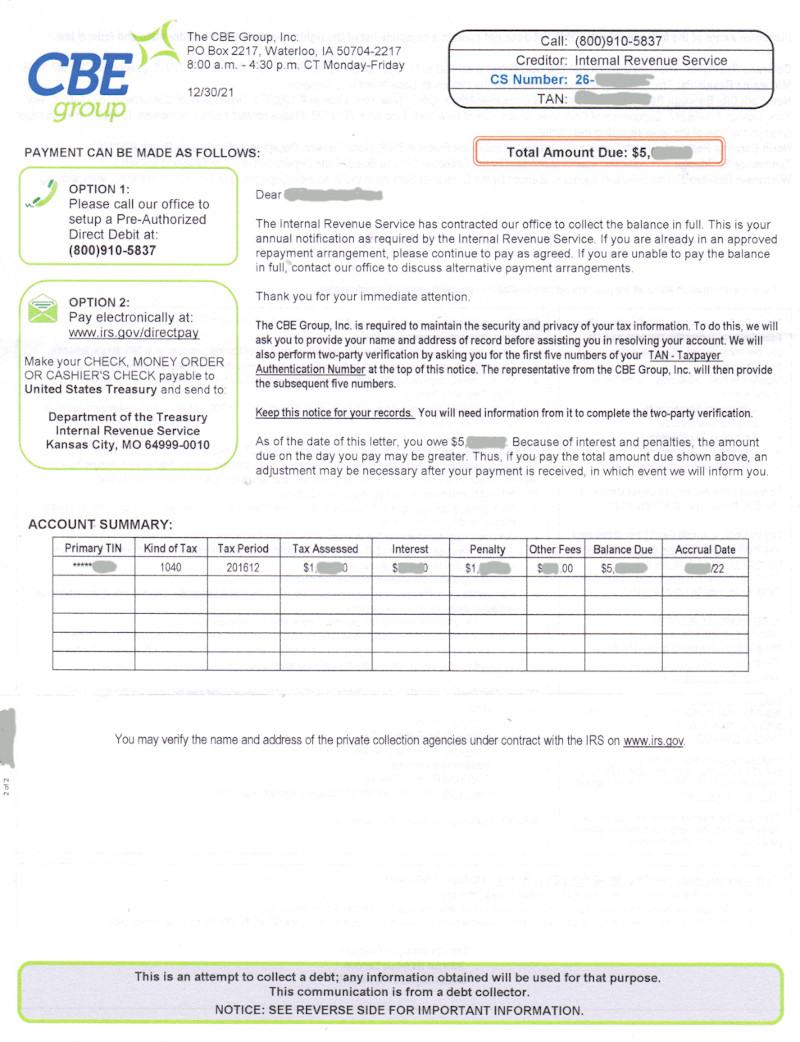

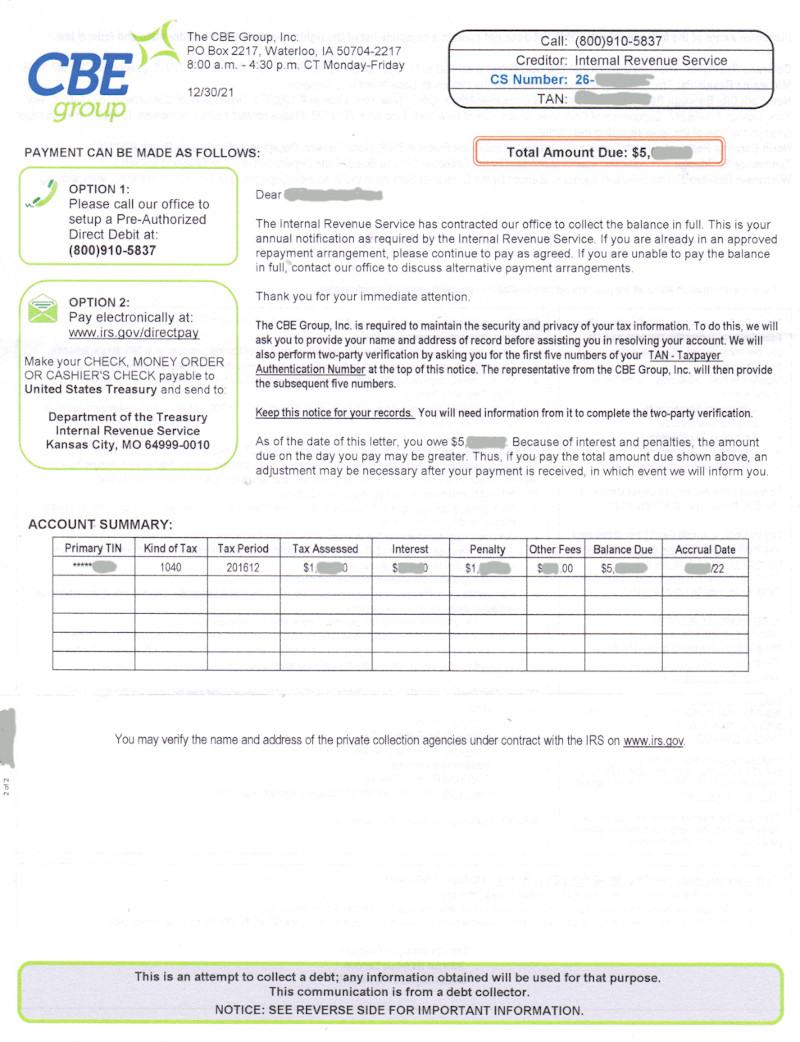

I found this interesting. My friends file a TY2016 return with a lawful money reduction on income. For whatever reason the IRS balks and sends out the 3176 letter "you filed a purported tax return..." etc. Don't know, maybe they did something wrong as it relates to David's method, but after back and forth without payment the IRS sends it out to a third party debt collector, CBE Group. Take a look:

But where is the enforced compliance? No wage garnishment, no lien, no levy. The primary taxpayer still has the W2 job (employment) and bank accounts. So the IRS certainly has the capability of just grabbing the $ but what do they do - ship it out to a debt collector! Friend says they've been getting these CBE Group collection letters for years but hasn't paid a dime.

Seems to me like this IRS debt is of a different nature. Like it's not really owed.

Posting Permissions

Posting Permissions

- You may not post new threads

- You may not post replies

- You may not post attachments

- You may not edit your posts

-

Forum Rules

Reply With Quote

Reply With Quote