Originally Posted by

jesse james

I guess I didnt make myself clear.

One of the forum members references that by endorsing a check into lawful money stops the federal income tax impositions.

I said I disagree with this premise because endorsing a check to receive lawful money instead of fiat is after the 3101 and 3402 impositions.

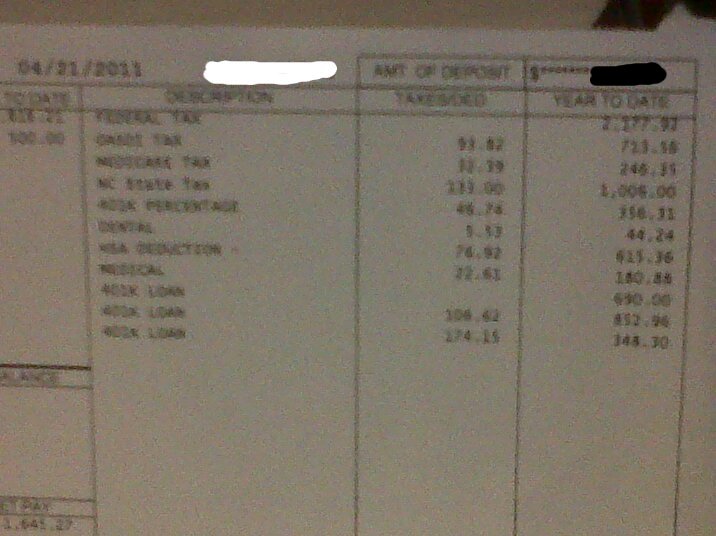

I couldnt wrap my head around how a check that already has the neccessary deductions deducted could stop the Social Security W3 reporting.

I showed this person regulations and law stating all IRS data comes from the W3 the SSA receives from the employer.

I tried explaining to this individual the liability and amounts reported is gonna still remain in the system and that to stop all liability the W3 has to be stopped at the source.....the employer.

Well the arguement continued until I just told him that I will no longer deal with him and his accusations that I was Larry from quatloos.

The guy just didnt want to listen to logic or reason.

Now I'm not saying anything about lawful money as you can redeem lawful money at will, but redeeming lawful money doesn't stop the requirements of reporting when its after the fact.

Reply With Quote

Reply With Quote