If you believe the issuer of the form is committing fraud there are forms for things like that too. If A claims to have paid B $10,000 when A only paid $1,500, B can demand the correction and cc the local IRS office on the communications. If A fails to correct, B can file an appropriate claim form.

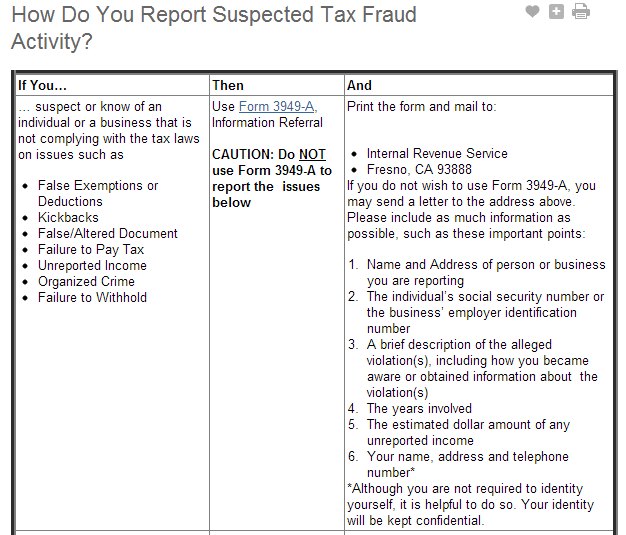

The IRS Form 3949-A "Information Referral" seems to be appropriate to the above topic.

Reply With Quote

Reply With Quote