Each individual transaction that uses FRNs generates more debt BECAUSE each one is a PROMISE to pay, an IOU-based transaction because it is based on liability (PROMISE) instruments. Each one of these needed to be backed-out by a corresponding REDUCTION entry!!! AWESOME!!!

One is actually helping to PAY debts and thereby reduce the national debt. One is helping correct the mistake THEY made by PRESUMING that FRNs were being used in such transactions. These must include all withholding-based transactions as well, since both the debt and the reduction is TRANSACTION-BASED! THIS IS S KEY CONCEPT THAT MUST BE UNDERSTOOD! Each transaction that assumes FRN usage must be backed-out (reversed) to settle the national debt.

One could easily prove each FRN transaction increases the national debt by auditing any check deposits at any bank and see if these funds are included in the reserve required for fractional reserve lending. One can see the multiplier effect in the diagram at that website, and also see why bank employees get fired for not respecting demands for lawful money, because all of the multiplier "ripples" of mistakenly-created and un-bonded debt that has to be backed-out/reversed!

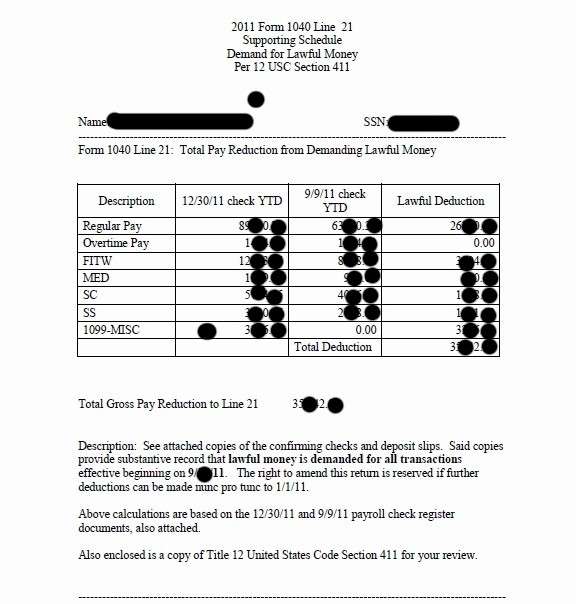

By following FRCP 803(6) rule of hearsay exceptions, one is making a substantive record on documents used in the normal course of business. By writing "lawful money is demanded for all transactions 12 USC 411" on all commercial instruments (deposit slips, checks, etc), one enables the equitable title transfer of the credit (labor) held by the the United States Treasury via the Federal Reserve Banks since the April 5, 1933 Executive Order 6102 of President Franklin D. Roosevelt, which transfer then enables the Trustee to setoff the national debt to that extent.

This reduction therefore, in effect if not in essence, constitutes FOR-GIVENESS of the national debt. It is applying the prepaid labor credit of the people loaned to the corporations that enabled them to pro-duce goods and services for the people.

The Beneficiaries have NOT been doing their duty of authorizing the application of lawful money to PAY debts, by demanding lawful for all transactions. Using FRNs is only a PROMISE to pay, and each such PROMISE is fractionalized, as well as each derivative transaction from the prime transaction which mainly is one's GROSS PAY-check.

Reply With Quote

Reply With Quote