The Form 1040 instructions clearly say that W2 Box 1 - Wages are to be entered on Line 1 so I don't know how you arrived at the 76817 figure for Line 1 -Gross Income.

This brings up an interesting topic. For a segment of our society filing a tax return is a money making event. Thanks to generous credits in the tax code like EITC & Additional Child Tax Credit, lower income filers can get refunds larger than amounts paid in through withholding. For example, a couple making $25k/yr with 2 Allowances would have $1300 Fed Tax (25x52) and $1924 SS/Medicare taxes (37x52) withheld, yet eligible for a refund over $6000 if they had 2 children.

I know David does not advise asking (claim) for more than the $1300 Fed Tax withheld, but it could make redeeming lawful money a hard sell for this certain segment.

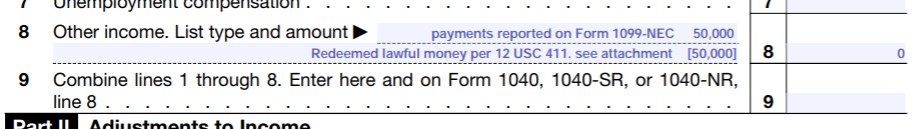

As for the reported Form 1099 income, I would list it as Other Income on Schedule 1 and subtract the amount of it redeemed in lawful money, as follows:

Reply With Quote

Reply With Quote