Are you going to walk us through filing a Lawful Money tax return this year? You know, sharpen your pencil, grab an adult beverage, fire up TurboTax ...

Are you going to walk us through filing a Lawful Money tax return this year? You know, sharpen your pencil, grab an adult beverage, fire up TurboTax ...

This page helps clarify your demand:

uscode.house.gov

No, I think you're all capable of filing on your own. The key being it's a tax on a certain kind of income; the federal income tax is really an excise tax on use of private Federal Reserve credit - easily avoided by redeeming lawful money. Besides that I'm too busy; dealing with a 1099 that's so big it's got a table of contents!

There's a new form this year 1040-SR “U.S. Tax Return for Seniors”

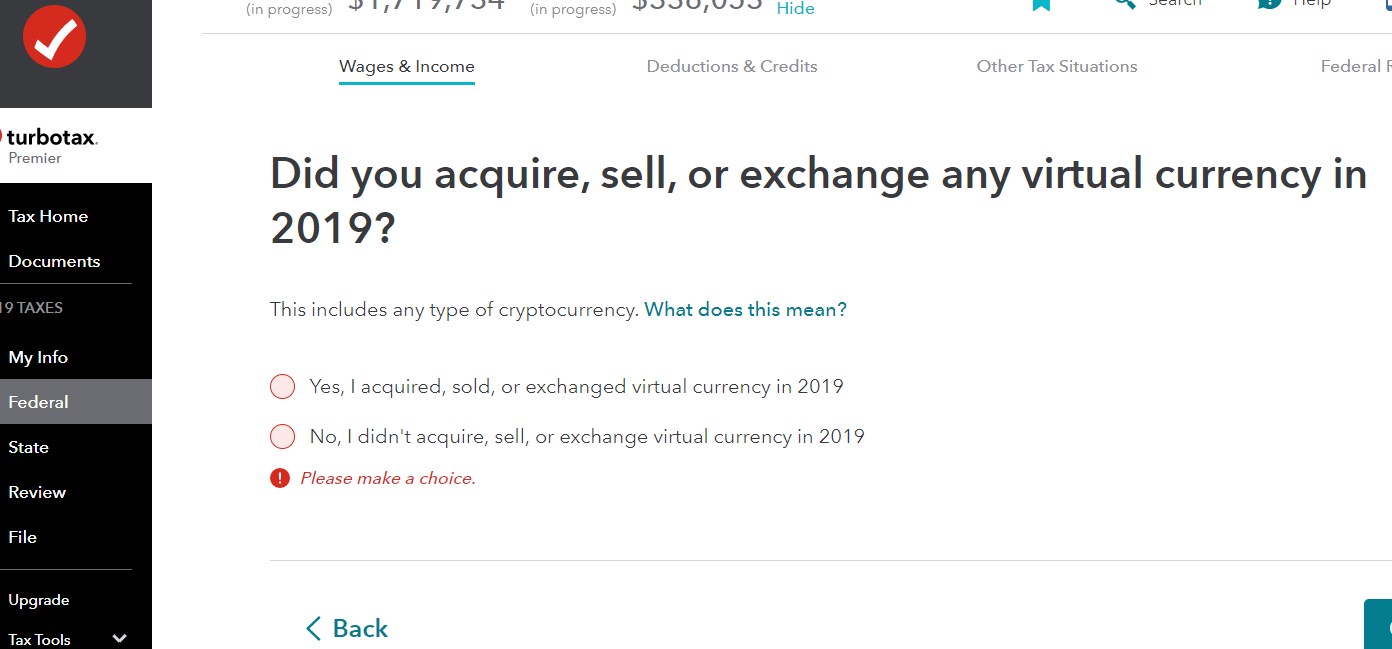

And a new question about virtual currencies. I can confirm that TurboTax (e-file) won't allow you to skip answering; it requires a Yes/No answer.