Originally Posted by

freedave

Thank you for this, Martin.

I don't see "US Treasury note" on the $5 or $20 bill. Does the fact that there is a U.S. Treasury seal and the signature of the Secretary of the Treasury make it a U.S. Treasury note?

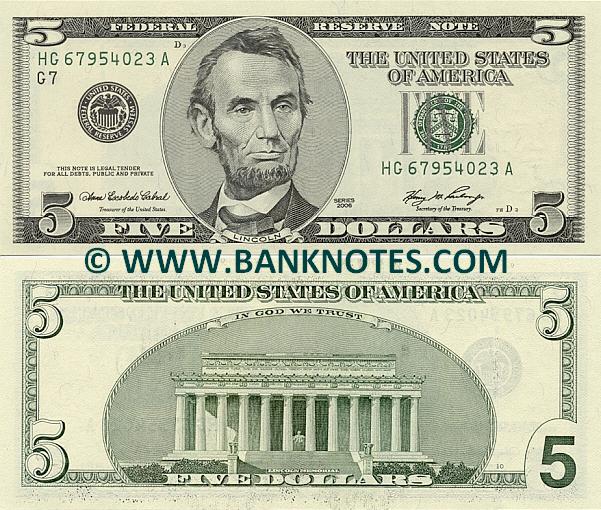

You cannot see "THE UNITED STATES OF AMERICA" and the Treasury seal on the right side of the NOTE? You cannot see the line between the 2 notes (hint: just because the line between the 2 notes is curved and artistic does not mean its not a Border between the notes, the line is around the dead President)? You cannot see the Secretary of Treasury Signature on the note? You cannot see the numerical value of the NOTE? You dont see "RESERVE NOTE" above the "UNITED STATES OF AMERICA?

Clearly, there are 2 notes there, with their own boarders, their own seals, their own serial numbers. Remember, when you put something in a box, it is its own "thing".

And are you saying that if I endorses a check, I am obligated to pay that amount of debt?

Of course you are, if the check bounces, does the bank come after YOU for payment or the endorser on the face of the check? This is so basic anyone with a checking account knows they assume full liability for the any deposit with their signature (unrestricted, open endorsement, of course). Not only that, you are obligated to pay face value plus interest in goods and services, since that is the deal Congress made with the FEDERAL RESERVE.

I don't see how paper fiat currency would become lawful money via endorsement

Then you have no idea what "endorsement" means and you need to look it up because it is basic contract law, you endorse it, you own it.

-- I thought the idea is to demand redemption in lawful money.