Resistance and Refusal by Banks

Collapse

X

-

This is AMAZING that I am reading this! I just, an hour ago, came from my bank asking to change/amend my signature card with the "Lawful Money" statement and the person I talked to said exactly what you have stated here. Thankfully she didn't make a decision based on her statement. She called "Legal" who said I must submit to them in writing why I want to add the statement to my accounts, which they will review and decide whether to approve the addition of said statement.

Any ideas what I should include as my "why"?

Originally posted by itsmymoney View PostGreetings, all.

David, and all in general,

I and many others have been experiencing resistance or downright refusals to change our signature card or open new accounts as such with a declaration that the account be redeemable in lawful money. I have a theory but I do not have proof one way or the other why these 'member banks' have been rejecting us.

USC 411 states that 'The said notes shall be obligations of the Unites States and shall be receivable by all national and member banks and Federal Reserve Banks...They shall be redeemed in lawful money on demand at the Treasury Department of the United States, in the city of Washington, DC, or at any Federal Reserve Bank.'

Here goes my theory based on the language in USC 411...

1) 'The said notes...shall be receivable by all [banks]'.

To me, receivable means they can accept Federal Reserve notes (with no talk of lawful money redemption at this point). So they can receive FRN's into virtually all banks.

2) 'They shall be redeemed in lawful money on demand at the [Treasury Dept, DC, or any Federal Reserve bank].

What strikes me is that 'member banks' are not included in the 'redeemable entity' list. The language could be interpreted in this manner by the 'member banks': any bank can receive FRN's into an account, but only the ones in the 'redeemable entity' list shall as obligated by law, redeem them in lawful money. So they are interpreting 'Federal Reserve bank' to mean the 12 known banks as such. Therefore, they (private, FDIC members, that ilk) interpret that they can receive your FRN's but are under no obligation to redeem in lawful money because they are not one of the '12 Federal Reserve banks'.

Although remedy exists via USC 411, the thinking is that if these 'member banks' are somehow excluded from the obligation, one would need to redeem in lawful money at one of the 12 Federal Reserve Banks or at the Treasury Department. Which for almost all of us would be incredibly impractical and frankly, incredibly unfair and not in good faith per USC 411.

Is there supporting law or documents for USC 411 that would clarify the above interpretation one way or another?

Thank you for any clarification or thoughts on this.

Comment

-

First off - get the request in writing.

As banks persist in exercising this option we might consider notifying the Fed about our demand, getting that into an evidence repository and just serving that same marked up Notice on the bank and forgetting about Signature Cards altogether. This is tiring.

Comment

-

Amen David!

*Make the demand by NOTICE.

*Use proper record forming.

Now where do the benefits of making the demand occur?

"...for all taxes, customs, and other public dues." [FRA Section 16 Note Issues; http://www.federalreserve.gov/aboutthefed/section16.htm ]

CC a copy of one's demand to any tax agency of perceived detriment and again don't forget proper record forming.Last edited by EZrhythm; 03-26-13, 06:11 AM.

Comment

-

M & T Bank Attempt at Lawful money request

I have been trying to have the "Redemption" novation added to my accounts or even a plainly stated denial of my request. Here is what has transpired thus far;

This my original letter to M & T bank. M&T Bank-redemptionRev.pdf

In addition I called the headquarters in Buffalo, NY and spoke with the customer care manager. Here is the reply I got.

In reply I sent the following; M&T Bank-redemption2ndrequestRev.pdf and as a response I got this;

They are clearly trying to avoid being on record either allowing a lawful money acct., or denying my request for one.

I shall be attempting to open accts at BoA and or Wells Fargo next week.Attached Files

Comment

-

What a terrific post! Thanks a lot.Originally posted by Darkmagus View PostI have been trying to have the "Redemption" novation added to my accounts or even a plainly stated denial of my request. Here is what has transpired thus far;

This my original letter to M & T bank. [ATTACH=CONFIG]1210[/ATTACH]

In addition I called the headquarters in Buffalo, NY and spoke with the customer care manager. Here is the reply I got. [ATTACH=CONFIG]1212[/ATTACH]

In reply I sent the following; [ATTACH=CONFIG]1209[/ATTACH] and as a response I got this; [ATTACH=CONFIG]1211[/ATTACH]

They are clearly trying to avoid being on record either allowing a lawful money acct., or denying my request for one.

I shall be attempting to open accts at BoA and or Wells Fargo next week.

Comment

-

Freed: You have gone to a great degree of trouble in your quest with BofA. I appreciate your adventurous spirit and willingness to share the details of your quest. However, I'm wondering if you are "tilting at windmills" like Don Quixote. I'm not being critical here, please don't interpret my comments in any personal manner. I'm just trying to clarify what your objectives are. Maybe the quest is your objective, I'm grateful that you would do that. However, if your objective is to actually get an account opened with "Redeemed in Lawful Money" (RLM) and associated verbiage on the signature card and have your direct deposit transactions deposited into it, then I'd make the following suggestion. Find a local state chartered bank and open an account there. I did that 3 or 4 years ago, and have been redeeming lawful money both with non-endorsed checks and like you with Social Security direct deposits. I have not tried to open an account for RLM in the last 12 months, but I have 3 accounts with the same bank all with RLM on the signature cards and have never heard a peep from them. Just my $.02 worth.

Comment

-

Got the signature card changed - now the bank wants me to change it back

I was going through the responses and did not find exactly my case. I opened a bank account in 1996. Later on I changed it to a revocable living trust account. A few weeks ago, the bank rep said the bank needed an update signature card. I said no problem. I signed By: John Doe, trustee, authorized signature. Underneath there was plenty of space to write: All transactions on this account are intended by demand to be redeemed in Lawful Money per 12 USC 411. Nunc pro tunc. This new signature card was done on 11-29-2013.

I decided to go back to the bank rep who is also a notary and asked her to do a notarized affidavit with the following verbiage:

On this 9th day of December 2013, I attest that the proceeding and attached document is a true, exact complete unaltered photocopy made by me of the ABC Bank signature card for JOHN DOE, as individual and trustee for the account 1XXXXX123 with the original opening of the account of December 13, 1996 and revised on November 29, 2013. The following was added to the bottom of the signature card: All transactions on this account are intended by demand to be redeemed in Lawful Money per 12 USC 411. Nunc pro tunc.

The rep signed this and notarized this AND the actual signature card.

Today, 12-13, I got a call from the rep and was told I need to come back and change the signature card as the bank does not accept the verbiage. I said to the rep, please have the bank send me a letter. And the conversation ended.

So this is my question: I am way past the 3 days - RFC. In reading different posts, I see the bank CAN close the account AND in other posts, the bank will try and trick you to close the account. The fact remains that I do have a notarized statement and signature card. Does the bank have the right to close the account without my acceptance? Does the bank have the right to ignore the demand for lawful money? What type of deceptive tricks can the bank really do?

My first thoughts were if the bank sent a threatening letter, I would send a response "something like" - I am under the impression that ABC Bank is part of the national banking system and must provide service to the public. The entity I use, John Doe is public property and therefore you must provide service. I am deeply concerned for the well-being of the public and the use of FRN increases the public debt; therefore causing a serious harm to the public. I believe the bank has had ample opportunity to reject the signature card but has NOW since waived its right. Therefore, if ABC Bank refuses to follow the laws of the US, including but not limited to accepting the demand for lawful money per 12 USC 411, I am left little choice but to forward this information for review and investigation by the OCC, FRB and SOT. Yours truly, Nice Guy

Oh I should also tell you I have been banking not only personally for about 3 years but also business depositing business check "redeemed in lawful money" for about a year. On the business, I probably deposited $800k in checks LOL. I can not answer for certain but I can suspect the tellers may have not done any special processing on those checks. I do not want anyone fired.

Any suggestions would be appreciated. Tony

Originally posted by David Merrill View PostThe signature card is an agreement. You make a novation (innovation) and that means they have three days to R4C your novation. Another method might be to put the demand on your payroll authorization for direct deposit. That involves your employer though and that is never wise.

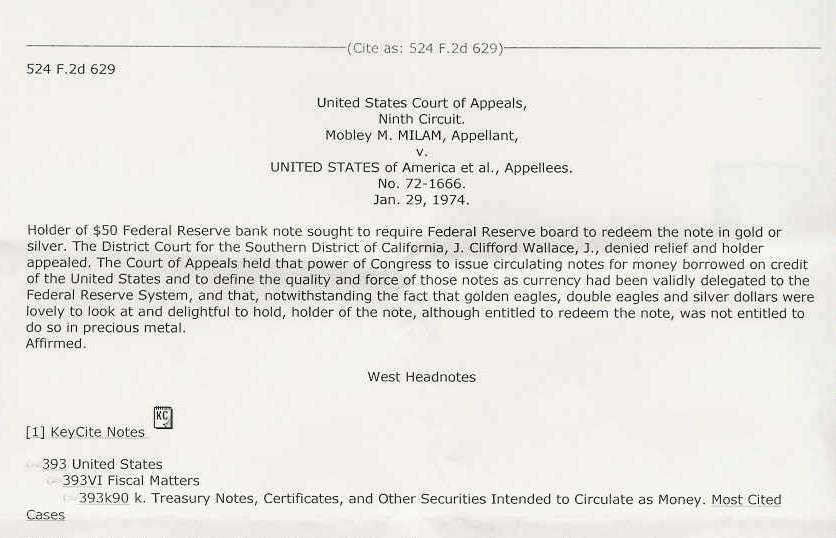

I think you are right on about the specifications of which banks may be redeemed but you do not get to bank at the Federal Reserve banks. They do not open accounts for people like you. So you either have the right to redeem or not. According to MILAM you do.

Which presents the question - Where do I go, if not my bank?

If your banker says you have to go to the Fed or that this only applies to state banks and not you and if he were correct then it would not make any difference and he should allow you to sign as you please. If you have no such remedy then it is just a fanciful addition - meaningless. We have the suitor who found employees being fired though, for making general deposits when they were to be special deposits to it does indeed matter.

My experience (through the brain trust) tells me that if the suitor knows what he is doing he will get the novation in place mostly because the bank has fiduciary responsibility to do business with you. In other words they may try convincing you to close down your account and if you are conditioned to obey, you will. They will not close down your account unless you are costing them like with the suitor where the employees were fired. That cost a lot so they shut down the accounts.

Comment

-

The banks' refusal of demands for lawful money are a stall tactic, designed to infuse doubt into the claim. The bank service agreement contains a lot of opportunities to create implied contracts, making you admit to being a 'US citizen' (read: debt slave), and stating that the bank will ignore anything written on the back of your check besides your endorsement. If you file your notice and demand in the public record, and then serve it on the bank, the demand will supercede the implied contracts on the bank signature page. But what if the bank denies your demand, as Bank of America did to me (thrice)? Can the bank refuse a demand for lawful money? Can they pretend that their refusal of your demand (notice: they did not refuse for cause; they claim the demand "has no legal significance") maintains the legal validity of your signature card on file? They can. Will it matter? I doubt it. Here is why: you make your demand, which takes your deposits out of the Federal Reserve fractional reserve lending system. These deposits of lawful money cannot be used for reserves. What it really means is that the bank cannot lend using your credit, because you refused to accept responsibility for the debt the bank wants to create in your name. By refusing to endorse new debt in your name, you avoid 'dealing in Federal Reserve debt securities,' which is the step which creates the irreccusable obligation to file a return and pay taxes on the private money you used. So you have no obligation to pay income taxes on these deposits. So you go to the IRS and file for a refund of all taxes withheld. The IRS says prove you redeemed. You produce (a copy of) your demand and the letter serving the demand on the bank. You have met the requirements of 12 USC 411: you made your demand. The bank, by pretending that your demand is meaningless, is just trying to plant that element of fear/doubt that maybe you can't believe everything you read on the internet. The banking cartel has been using lies, fraud, and misdirection since 1692, don't let it bother you; press on.

ps. I believe my bank wants to deny the demand because they do not want to have agreed in writing that my deposits are now special deposits, which must be returned in kind, rather than general deposits, which become unsecured loans to the bank. Bank of America has been planning for some time to go bankrupt, and the current plan is that when they do, they will confiscate the depositors accounts, which they can do because the account agreement they make you sign makes you an unsecured creditor, ie, you will stand at the end of a long line of secured creditors during a bankruptcy. Special deposits would be at the front of that bankruptcy line, as their confiscation would constitute theft by bailee...

Freed

Comment

-

I am not sure I got it when the suitor explained this to me. Look on the last page at the email he sent me. What he said is that by not being in the Table there are no set guidelines or forms for making your demand proper. I get that much easily.

What he said though is that you only have to prove that you have made your demand one time and one time only, and that is good for life.

Comment

-

Am I wrong to understand that unless a check (or similar instrument) is endorsed, it is non-negotiable? And that banks can accept deposits even endorsed in blank? I'm sorry to go over ground that I'm sure has been covered most exhaustively on this site, but unless there is an endorsement, then the instrument remains non-negotiable.

So "non-endorsing" is an attempt to enter an instrument into the banking system without liability. Great! This seems to be (to me) the source of all the problems with banks. They're just not set up to deal with demands for lawful money. I think that's why the statute says demand must be made at Treasury or at one of the 12 Federal Reserve Banks.

Now lately I've been wondering about sending notice of demand to the Treasurer (Rosie Rios), maybe even asking her to provide an identifying number of some sort identifying my particular demand (or asking her to agree to one I provide); and then continuing to make deposits at my normal bank by writing down on the back the account number only. When the checks clear, write a check made out to "Lawful Money" and use the cash. After all, the people from whom I accept a check are dealing in banking credit. It only seems fair to follow their request.

At that point - since I never actually receive anything but cash - I can't imagine why I would need to file a return.

Thoughts?

Comment

-

Below is the rest of the email... It does NOT say one only needs to do it ONCE. In fact ever since 9/15/2011, I have handwritten my exact specific declaration on the FACE of every check and deposit slip I issue.... just to make it CLEAR by a PREPONDERENCE of substantive evidence under their FRE Exception to Hearsay Rule 803(6)(B) that from that date onward "lawful money and full discharge is demanded for all transactions 12 USC 411, 95a(2)" applies to ALL transactions even if it is missing thereafter on transactions like direct deposits, debit/credit cards, EFTs, etc, where it is hard to make a record of one's demand. Remember, by making one's demand TRANSACTION-BASED, it does not matter what the signature card has on it or not. The account does not matter - BECAUSE YOU MADE YOUR DEMAND TRANSACTION-BASED - Please get this point! It is CRITICAL! One does NOT have to send letters to the bank, IRS, FRS, IMF, Treasury or Employer and thereby stir up needless trouble! Okay? IMHO - K.I.S.S.Originally posted by David Merrill View PostI am not sure I got it when the suitor explained this to me. Look on the last page at the email he sent me. What he said is that by not being in the Table there are no set guidelines or forms for making your demand proper. I get that much easily.

What he said though is that you only have to prove that you have made your demand one time and one time only, and that is good for life.

....

The Parallel Table of Authorities has no entry for 12 USC 411. This table's entries go in sequence from 12 USC section 391 to section 418. Section 411 is missing. This is confirmed at http://www.gpo.gov/help/parallel_table.txt, excerpted below:

[Code of Federal Regulations]

[Parallel Table]

[Revised as of January 1, 2011]

[From the U.S. Government Printing Office via GPO Access]

PARALLEL TABLE OF AUTHORITIES AND RULES

12 U.S.C. <---------------------------> Corresponding C.F.R.

================================================== =====

378............................................... ...........12 Part 303

391....31 Parts 202, 203, 209, 210, 225, 240, 306, 317, 321, 341, 346,

..............351, 352, 353, 354, 355, 356, 357, 358, 359, 363, 375, 380

418.................................................. ......31 Part 601

461........................................12 Parts 201, 204, 208, 217

"Therefore it is legitimate and preferable to make one's demand TRANSACTION-BASED, to wit:

"lawful money and full discharge is demanded for all transactions 12 USC 411 and 95a(2)"

Using this exact wording above enables one to provide probable cause and justification for listing all transactions on a custom-made 1040 SUPPORTING SCHEDULE that have been presumed to be using FRNs!!!

Who can rebut that demand? And by what authority? 12 USC 411 does NOT specify any wording requirement or transaction frequency, and there is no corresponding CFR regulation that requires anything.

One does NOT need to put it on any bank signature card, or on any contract!

Just decide on the date one wants to begin the demand and then start hand-writing it on the face of one's checks and deposit slips, just under one's name and address in the upper left-hand corner of the document. This then stands nunc pro tunc (now for then), thereafter and forever, as substantive evidence per FRCP 803(6) governing exceptions to hearsay evidence, and is unrebuttable.

This is the starting date of one's FREEDOM. Make it memorable!!

I believe making a clear public record that creates substantive evidence of all transactions demanding lawful money is the key, all done in good faith reliance on 12 USC 411 and 12 USC 95a(2), AND on the Father and His Son, who evidently have commanded this as a red line in the sand to be observed by all parties (including Satan) in this issue, namely Mt 22:21.

Beware of becoming an unwitting tool of the Adversary by undermining and doubting the remedy provided by the Creator that He promised to provide to His People in 1 Cor 10:13.

Remember the words given to Joshua in Joshua 1:9, and to Peter by the Messiah in Mt 14:31.

So claim this promise of remedy. Be courageous. Have faith!

Peace."

And I add now: Beware of adding regulations WHERE THERE ARE NONE, and thereby making the road more difficult for those that follow us who have successfully gotten refunds!

SUGGESTION: As a second witness, one might also record a Declaration in the public record about this starting date of lawful money demands, and attach as Exhibits the first several checks and deposit slips... and several more throughout that year for good measure.

NOTICE: Lawful Money Demand (12 USC 411) is only 1/3 of the remedy - Full Discharge (12 USC 95a(2)) is second 1/3 - and Claim for Harm by a man in his court of record at a public court building using his record declared at the county recorder is the last 1/3. More info on this is available at iuvdeposit.wordpress.com

It looks to be an interesting year in 2014... 14 means "DELIVERANCE" in the Bible. The Passover, as you know, was on the 14th.Last edited by doug555; 12-23-14, 07:54 PM.

Comment

-

That sounds genius! Open an account with the US Treasurer, by number and use that.Originally posted by Keith Alan View PostAm I wrong to understand that unless a check (or similar instrument) is endorsed, it is non-negotiable? And that banks can accept deposits even endorsed in blank? I'm sorry to go over ground that I'm sure has been covered most exhaustively on this site, but unless there is an endorsement, then the instrument remains non-negotiable.

So "non-endorsing" is an attempt to enter an instrument into the banking system without liability. Great! This seems to be (to me) the source of all the problems with banks. They're just not set up to deal with demands for lawful money. I think that's why the statute says demand must be made at Treasury or at one of the 12 Federal Reserve Banks.

Now lately I've been wondering about sending notice of demand to the Treasurer (Rosie Rios), maybe even asking her to provide an identifying number of some sort identifying my particular demand (or asking her to agree to one I provide); and then continuing to make deposits at my normal bank by writing down on the back the account number only. When the checks clear, write a check made out to "Lawful Money" and use the cash. After all, the people from whom I accept a check are dealing in banking credit. It only seems fair to follow their request.

At that point - since I never actually receive anything but cash - I can't imagine why I would need to file a return.

Thoughts?

Negotiable and Non-Negotiable take on an atypical meaning in terms of endorsement and non-endorsement.

This particular image was a bounced paycheck.

The bank returned it but with the non-endorsement torn off.

Negotiating instruments involves fiduciary responsibility. What I mean in this context is that it is illegal in the corporate sense to trade down currencies. Except in the case of the Federal Reserve note (the Fed is only an instrumentality of the US because it has been sanctioned for its notes [stock certificates] to depreciate over time, by Congress] all stock certificates, even unit shares of a private trust are ALWAYS intended to increase in value over time.

Therefore the only legitimate trade for FRN's is to trade up, and the only currency available upward is US notes, a non-reserve currency.

Comment

Comment