Lawful money

Collapse

X

-

The blessing is in the hand of the doer. Faith absent deeds is dead.

Lawful Money Trust Website

Divine Mind Community Call - Sundays 8pm EST

ONE man or woman can make a difference!

-

Thank you Michael Joseph. The timing of that particular example bridges and connects many dots about FRNs being bank markers and insurance policies.

Comment

-

Shikamaru;

Thank you for that Article. It is from a 1909 book by Victor MORAWETZ and that timing is important to me. I did not take time to read through carefully until this morning and of course am processing through a new demonstration that is being sanitized. I feel that I can describe it.

The IRS was threatening to levy a small company for $5K in penalties. The company called the IRS agent to work out a payment plan and the agent claimed no authority to deal but recommended the Abatement Form. The company filled out the form and Attached a typical Deposit Slip that had the Stamp on it. On the Attachment was:

III. We should not presume the IRS has the right to seize our property, as proposed. If the IRS were to levy our bank account property interesting legal and jurisdictional issues would result considering that a portion of said account contains redeemed lawful money pursuant to 12 USC Section 411.

For science sake I regret that there were four reasons given in argument so one might say that any or all contributed to the forgiveness. You should see a sanitized package of the documentation soon.

What I truly appreciate about your find Shikamaru is that in 1909 we find the banks keeping two separate ledgers between lawful money and bank notes.Last edited by David Merrill; 09-11-12, 02:27 PM.

Comment

-

Good Morning Shikamaru;

I tried to share your Find with the Quatlosers:

Hello David Merrill,

You are receiving this notification because your post "Re: "Redeeming

Lawful Money"" at "Quatloos!" was disapproved by a moderator or

administrator.

The following reason was given for the disapproval:

Proof or silence.

--

Thanks, The Management

Comment

-

I get the exact same. And also the following. Since June 1st I've posted 20 times with 5 approved.

Hello Harvester,

You are receiving this notification because your post "Re: DMVP and People

Who Know about Currency" at "Quatloos!" was disapproved by a moderator or

administrator.

The following reason was given for the disapproval:

Claim of success in violating the law without providing verifiable proof.

--

Thanks, The Management

Comment

-

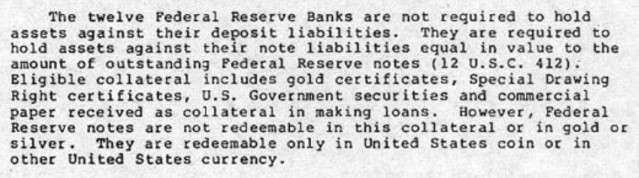

Shikamaru, can you please provide the citation/link to this? "The Congress has specified that Federal Reserve Banks must hold collateral equal in value to the Federal Reserve notes that the Federal Reserve Bank puts in to circulation. This collateral is chiefly held in the form of U.S. Treasury, federal agency, and government-sponsored enterprise securities" Thank you.

Comment

-

Originally posted by Goldi View PostShikamaru, can you please provide the citation/link to this? "The Congress has specified that Federal Reserve Banks must hold collateral equal in value to the Federal Reserve notes that the Federal Reserve Bank puts in to circulation. This collateral is chiefly held in the form of U.S. Treasury, federal agency, and government-sponsored enterprise securities" Thank you.

That comes from here, here , here and here.

Think of SDR's (paper gold) Special Drawing Rights as the measure of a society's conditioning to endorse private credit from the local central bank (here, the Fed). That measure has for quite some time replaced gold and has even become a currency in itself that can act as a reserve. But then, all the Fed needs to do is tell the Treasury to print more bills or even more "0"s toward the end of them. (Add two "0"s to a $1 bill and it is worth 100 times as much!)

Last edited by David Merrill; 09-12-12, 11:20 PM.

Last edited by David Merrill; 09-12-12, 11:20 PM.

Comment

-

-

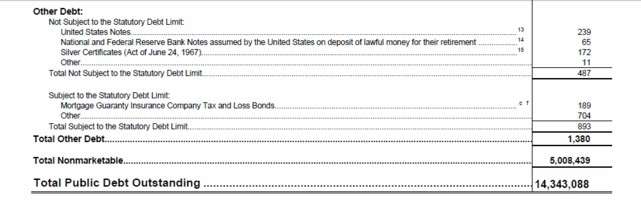

This may be of some interest to some:

Net worth of the Federal Reserve Banking System and balance sheet

Comment

-

Originally posted by Goldi View PostShikamaru, can you please provide the citation/link to this? "The Congress has specified that Federal Reserve Banks must hold collateral equal in value to the Federal Reserve notes that the Federal Reserve Bank puts in to circulation. This collateral is chiefly held in the form of U.S. Treasury, federal agency, and government-sponsored enterprise securities" Thank you.

Not trying too hard, this is what I could come up with:

Other than that, one could try combing through Title 12 of the USC.Last edited by shikamaru; 07-06-13, 11:53 AM.

Comment

-

federalreserve website quote

This is the link directly to the .gov site with that quote:

Originally posted by shikamaru View Post

Comment

Comment