Redeeming Lawful Money on Daily Paul

Collapse

X

-

Redeeming Lawful Money on Daily Paul

Tags: None

-

The Dailypaul is where I first encountered you , Mr. Merril. You have set me on a new course. Thank you!

-

Thank you! People benefitting from law and my intellectual property is quite rewarding.Originally posted by DebasedCurrency View PostThe Dailypaul is where I first encountered you , Mr. Merril. You have set me on a new course. Thank you!

Comment

-

Questions

Ok, I found this site through DailyPaul and am beginning the process. By the way, this is incredibly exciting. (I have also posted the questions on DailyPaul, but haven't heard a reply, so here goes...)

1. If "in elastic" currency, us bank notes, is fixed at 300 million, what happens if/when there are enough suitors demanding their lawful money to exceed that number?

2. I receive personal checks/money orders etc in the line of business I am in, can these be redeemed with lawful money?

3. Can I write a check demanding the pay or redemption of said check be paid or disbursed in lawful money?

4. Now, I've heard it both ways... since Federal Reserve notes have a prior lien on them, people stamp all their cashed paychecks this way, and don't have to pay income tax because they aren't receiving real money. I've heard it the other way, people claim to be paid the demand that payment in lawful money, which cannot be withheld or used as payment for interest on the national debt, so therefore don't have to pay the IRS.

Comment

-

I have been redeeming lawful money since early Dec 2012. I have not had a single question from any teller yet. They don't even blink! Once I started redeeming LM, my deposits started having different codes instead of saying "Deposit" there. It takes about 3-4 days but then it eventually reads "Deposit".

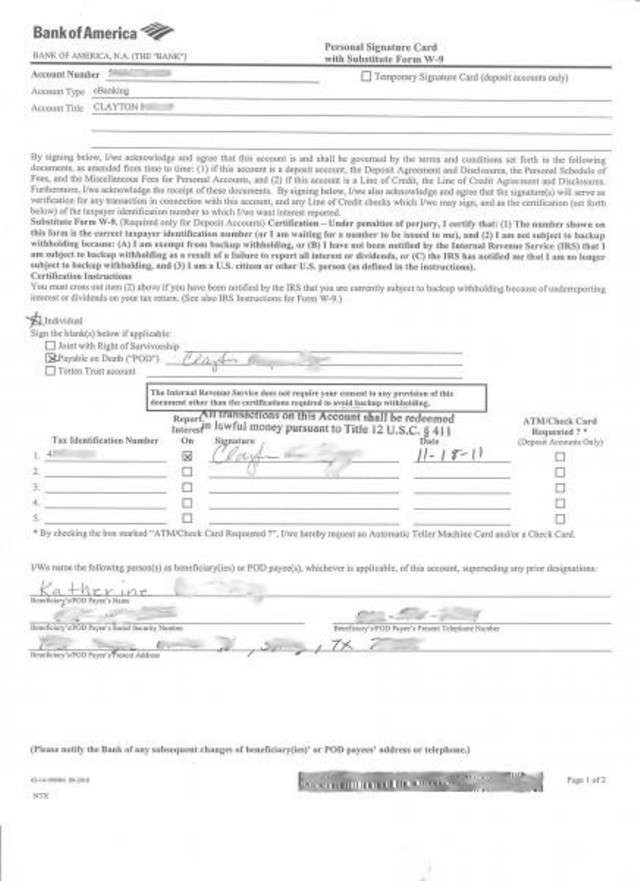

The officer who set up my bank account (from a business account transformed into a non-interest bearing customer account) said he wasn't sure if I could annotate the card. He is a 22 year old kid! He told me to ask the legal department who, when I got in touch with them OBVIOUSLY told me I can't do it... why would they want me to be able to deposit money they can't fractionally lend on??

Anyhow, here's what I need to put on the contract soon, or send a certified document stating thats how it will be. Either way, I ONLY deposit lawful money.

Picture of the disclaimer on the note was an actual 1990 series $20 FRN I had and am kicking myself for spending, as I used to use it to enlighten people. I CANNOT find a duplicate image showing the date on the web. I have found up to a 1960 or 1980 full disclaimer on the web. The bills with the full disclaimers appear to be a variation after 1960-1980 (not sure) as some have the full disclaimer and most do not, but it appears ALL had them 1960 and prior (This is anecdotal evidence from me searching).

Comment

-

I also dont make "copies" of these. I use my iphone and snap a pic, front and back and have created a separate gmail accounts for all my documenting needs. I have one that is "income" only. Each account is a free 10gig storage space. I do the same for all my receipts, because if I dont get it logged IMMEDIATELY, it gets lost. Heres the contract and how I SHOULD'VE annotated it

Comment

-

Question #1 is interesting. My theory is, when demand is made, US notes are created by operation of law. The one making the demand invokes the remedy, and Treasury issues the currency, albeit indirectly. Just a thought. I'm sure others have better thoughts on that.Originally posted by mikecz View PostOk, I found this site through DailyPaul and am beginning the process. By the way, this is incredibly exciting. (I have also posted the questions on DailyPaul, but haven't heard a reply, so here goes...)

1. If "in elastic" currency, us bank notes, is fixed at 300 million, what happens if/when there are enough suitors demanding their lawful money to exceed that number?

2. I receive personal checks/money orders etc in the line of business I am in, can these be redeemed with lawful money?

3. Can I write a check demanding the pay or redemption of said check be paid or disbursed in lawful money?

4. Now, I've heard it both ways... since Federal Reserve notes have a prior lien on them, people stamp all their cashed paychecks this way, and don't have to pay income tax because they aren't receiving real money. I've heard it the other way, people claim to be paid the demand that payment in lawful money, which cannot be withheld or used as payment for interest on the national debt, so therefore don't have to pay the IRS.

Comment

-

This is where the treasury secretary invokes the bank holiday, at least that is what I was thinking.Originally posted by Keith Alan View PostQuestion #1 is interesting. My theory is, when demand is made, US notes are created by operation of law. The one making the demand invokes the remedy, and Treasury issues the currency, albeit indirectly. Just a thought. I'm sure others have better thoughts on that.

Any further answers on questions 2 - 4? The question regarding an IRS stance on lawful money I feel is important.

Comment

-

A specialized Libel of Review is in process demanding that the US note be unpegged from the FRN. Otherwise I agree that #1 would likely result in a bank holiday. Not so much because of the US note though, just because that is what state banks were about to do in 1933 causing that bankers' holiday.Originally posted by mikecz View PostOk, I found this site through DailyPaul and am beginning the process. By the way, this is incredibly exciting. (I have also posted the questions on DailyPaul, but haven't heard a reply, so here goes...)

1. If "in elastic" currency, us bank notes, is fixed at 300 million, what happens if/when there are enough suitors demanding their lawful money to exceed that number?

2. I receive personal checks/money orders etc in the line of business I am in, can these be redeemed with lawful money?

3. Can I write a check demanding the pay or redemption of said check be paid or disbursed in lawful money?

4. Now, I've heard it both ways... since Federal Reserve notes have a prior lien on them, people stamp all their cashed paychecks this way, and don't have to pay income tax because they aren't receiving real money. I've heard it the other way, people claim to be paid the demand that payment in lawful money, which cannot be withheld or used as payment for interest on the national debt, so therefore don't have to pay the IRS.

#2. Because of confusion to newbees I think I should say that Congress has pegged the US note in value to the FRN. Therefore your act of redemption is limited to making your demand. Make your demand. I do not think there is anything anywhere saying you cannot demand stuff.

#3 Yes! That is what we are saying. Welcome and enjoy reading about it here on StSC.

#4 ??

Please try rephrasing that.

Comment

-

-

-

Originally posted by Keith Alan View PostI would like to see a discussion about that as well.

David,

Let me just say your responses on this site are extremely appreciated. I also apologize for asking maybe what seem to be obvious questions, but, I am in the process of trying to form a process flow chart with the 3 or 4 steps to begin this process. Each step will have links with supporting text / photos, but, I really want to wrap my head around this, so once again, thank you. Basically I find bits and pieces here on the site, but, a condensed version, bringing all the info together is my goal.

Yeah so question #4, I've heard stating all your income was in FRN and not really lawful money has been a claim to the IRS as a reason for not having to pay taxes. Well, because FRN's aren't lawful and not really anything of substance, therefore you never really received anything for pay and you can't be taxed on something that you didn't receive. So that is one side of the coin, and I thought I saw a thread describing exactly this reason was listed in a memo to IRS agents as a frivolous claim.

The other side of the coin, if all your income is in LAWFUL money, not FRN's, the IRS can't tax it. You can claim all your withholding's are due back to you. This is obviously the most interesting part, and I among others would like to hear a description as to why. I LOVE the idea of not allowing my bank to expand my money and will definitely pass on an interest bearing account if it is necessary to accomplish this end. So yeah, why can't the IRS tax lawful money?

I guess when a bank makes a loan through fractional reserve banking, the money has just been created, increasing the overall supply in the system. What I'm having a tough time wrapping my head around... Does it ever go the other way, does the supply shrink, because how I see it, this system has created a money spewing beast that never gets smaller and always creates interest for the money grabbing octopus we know as the federal reserve.

Comment

-

There is a passage in the Bible at James 1:25-28 or so about doing and hearing. You might have to trust me about this for the first step - make your demand. If you have direct deposit and your boss wont consider giving you a paper paycheck then it starts to get complicated but like Michael Joseph points out there are a lot of banks around for most people. Then you might consider changing your signature to "Lawful Money" or "Lawful Money Demanded"? - Just do that across the board. Tell your bank that your signature has changed and so you need to revise your Signature Card to your new signature.

People pay me cash and that is lawful money for all intents and purposes. Without Step 1 above though, evidence has convinced me, like with your post that the remedy will be evasive for you. What I just did was reduce it down to one simple execution but you are probably conditioned not to change your signature, aren't you? The people at your bank may be upset about it too, heaven forbid.

But this kind of thinking comes natural to me after sharing experiences with intelligent people like you who are coming out of bondage (conditioning).

My signature is David Merrill in paleo-Hebrew. I changed it to that a decade ago. But whenever somebody makes me sign for cash - like with a cash refund, and of course I want the cash I sign "Lawful Money". I do not even sign cursive. Hebrew by the way is all upper case and cursive is completely foreign to it. Punctuation and the vowel sounds (jots and tittles) were foreign to Hebrew in the time before Babylonian Captivity. Nebuchadnezzar knew how to discombooberate the Israelites - he captured the intellectuals into Babylon for seventy years and changed their alphabet and their names too!

Think that over. Your remedy is as simple as you making a simple demand. A principle behind this truth is, If you ask, it shall be delivered unto you. Or - Seek and you shall find.

Are you already demanding lawful money? Great! To your question then:

You want flowcharts? This is the Diagram for Are You Lost at C?

That is probably too much to understand but the tax exemption is expressed in the IRC as Mandatory Exception in .

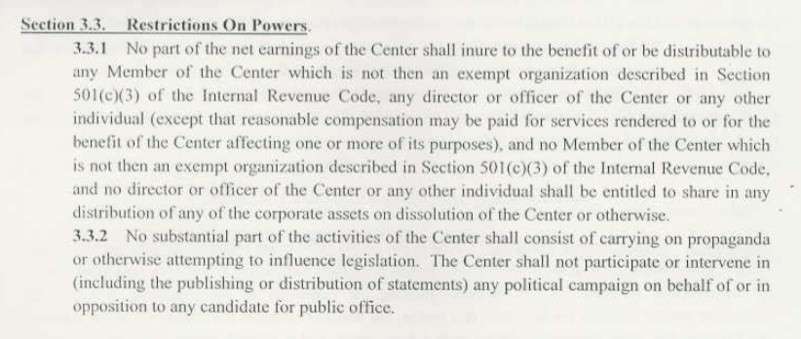

If you want to be the good church do not register for 501(c)(3) because that is a non-profit religious organization akin to the Olympic Committee for one example; the religion of sports competition? Hey! Whatever captures the minds as an opiate - in the modern rendition of Nebuchadnezzar!(c) Exceptions

(1) Mandatory exceptions

(A) churches, their integrated auxiliaries, and conventions or associations of churches, or

A close semblance is corporation sole. Like a town mayor or the Pope. But I suggest you be like a corporation sole, not to register as one. [Eddie KAHN on Wesley SNIPES conviction served time in prison on this registered rendition of The Good Church.]]

So simply study what the church is as in ecclesia that is pleasing to God.

Here is an example of current bylaws for a 501(c)(3) church for contrast:

All the members are presumed to be 501(c)(3) churches as they await approval and the IRS awaits their applications! It is a nasty trick to pull but then again, it is easy to understand and avoid once you ask the Holy Spirit for direction. Here is a great lesson; the pastor saying this was packing in two weeks!

Comment

-

David,

I think I lost you after Hebrew. Yes, I am going to change my signature card. I will talk to the bank, maybe get something in writing declaring my account as non-interest bearing. But, outside of filing myself as some sort of church/organization, I really was looking for someone's returns, or a sample of the law stating that lawful money isn't taxable.

Also, I'm assuming opening a evidence repository is solely for those interested in filing lawful money to the IRS as support of their claims. As well if the bank was to fractionally lend your account, this evidence repository could be used. Either way, I'm trying to boil this down into a pamphlet I could give my family, my friends to describe the process of demanding and why. The way I look at it, if this money is tax free, awesome, but the biggest part of this is the patriotic step of not increasing the debt.

Anyone else?

Comment

-

It will be great to hear other explanations. Section 508 is about the clearest you will find at describing anything that exists outside the scope of the IR Code.Originally posted by mikecz View PostDavid,

I think I lost you after Hebrew. Yes, I am going to change my signature card. I will talk to the bank, maybe get something in writing declaring my account as non-interest bearing. But, outside of filing myself as some sort of church/organization, I really was looking for someone's returns, or a sample of the law stating that lawful money isn't taxable.

Also, I'm assuming opening a evidence repository is solely for those interested in filing lawful money to the IRS as support of their claims. As well if the bank was to fractionally lend your account, this evidence repository could be used. Either way, I'm trying to boil this down into a pamphlet I could give my family, my friends to describe the process of demanding and why. The way I look at it, if this money is tax free, awesome, but the biggest part of this is the patriotic step of not increasing the debt.

Anyone else?

Mandatory Exception for churches.

Comment

Comment