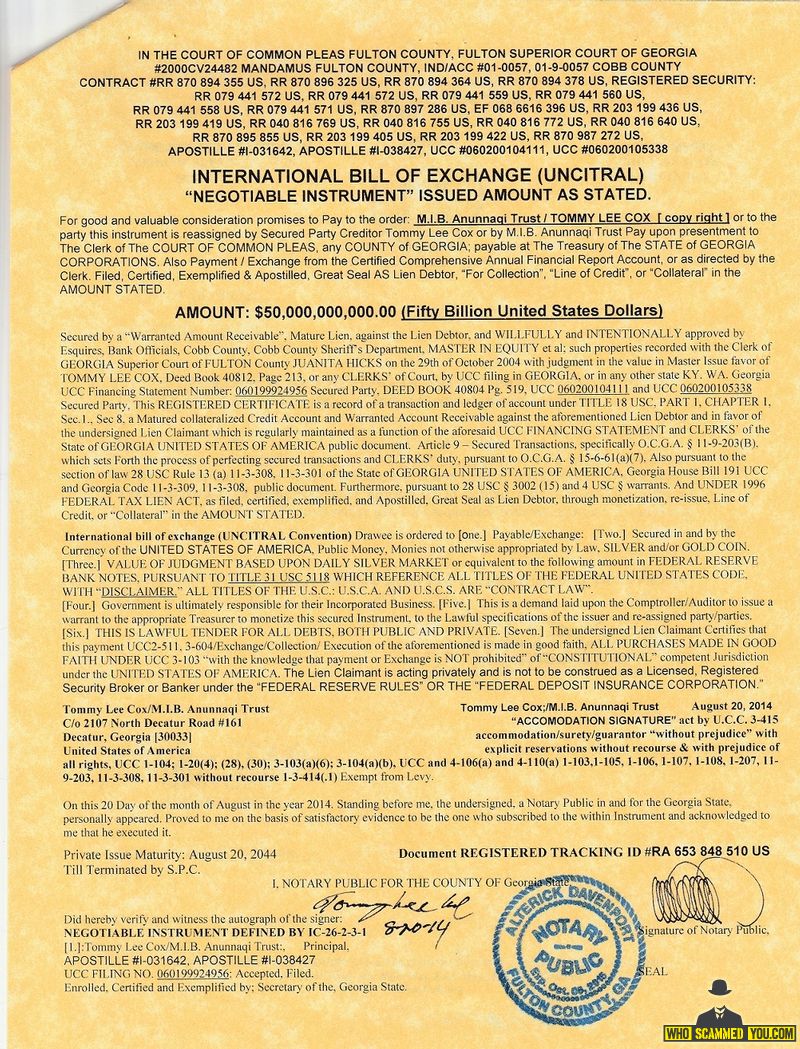

I have some PACER information. You can bring in more information if you sign up for PACER. I find it sad that Winston could have avoided this headache by applying remedy, by demanding lawful money.

Since I find enjoyable things much more enjoyable, I may not be spending a lot of time on this.

Since I find enjoyable things much more enjoyable, I may not be spending a lot of time on this.

I take the stance that the likes of exemption, immunity, forgiveness (cancellation of debt) have value. Afterall, if it is the extant sovereign that declares what is or what is not money, then at the fount of money would be sovereign prerogative, no? Relevantly, a sovereign's duty to promote equity goes without saying IMHO. [Is a ruler that is a terror to good works a ruler at all?]

I take the stance that the likes of exemption, immunity, forgiveness (cancellation of debt) have value. Afterall, if it is the extant sovereign that declares what is or what is not money, then at the fount of money would be sovereign prerogative, no? Relevantly, a sovereign's duty to promote equity goes without saying IMHO. [Is a ruler that is a terror to good works a ruler at all?]

Comment