I was wondering what experiences, if any, people are having when taking a lump-sum distribution from a retirement account using lawful money remedy.

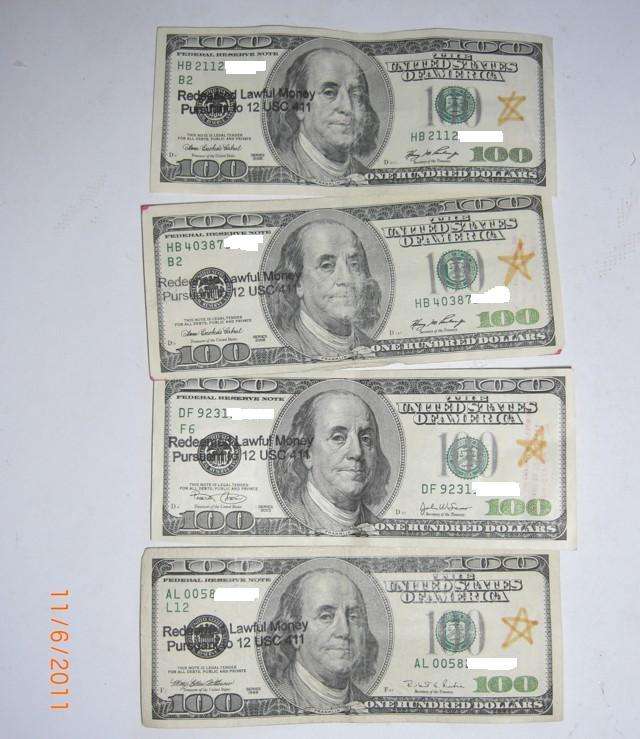

I suppose the typical scenario would be to take the distribution in the form of a check, non-endorse it per 12 USC 411, then file a 1040 to get a refund of all taxes withheld, which amount to 20% plus an extra 10% if withdrawn before age 59-1/2.

It seems to me, one should be able to circumvent the withholding with a lawful money demand and receive the entire distribution. Has anyone been able to do this?

The attached pdf file is an example of how a distribution request form could be filled out. Although, due to the high level of ignorance and resistance out there, this approach may not be the best way to go.

Distribution_Request_Form.pdf

Any thoughts?

I suppose the typical scenario would be to take the distribution in the form of a check, non-endorse it per 12 USC 411, then file a 1040 to get a refund of all taxes withheld, which amount to 20% plus an extra 10% if withdrawn before age 59-1/2.

It seems to me, one should be able to circumvent the withholding with a lawful money demand and receive the entire distribution. Has anyone been able to do this?

The attached pdf file is an example of how a distribution request form could be filled out. Although, due to the high level of ignorance and resistance out there, this approach may not be the best way to go.

Distribution_Request_Form.pdf

Any thoughts?

Comment