Originally posted by gdude

View Post

Resistance and Refusal by Banks

Collapse

X

-

That will suffice but Registered with integrated Certificate of Mailing is best.

-

You have no proof of what was inside the envelope.Originally posted by gdude View PostI think most courts will accept USPS certified receipt, as proof of mailing.... You really don't need the confirmation signature, but it helps.

Comment

-

What to do next when bank refuses to open account

Thank you all for all your input - it is well appreciated.

I went to Well Fargo on January 22 with my mom to open a non-interet bearing checking account. I had asked the rep to add the following to the signature card - "All transactions on this account are intended by demand to be redeemed in Lawful Money pursuant to Title 12 USC 411. All transactions with this bank will be done by Special Deposit. Nunc Pro Tunc". Needless to say the manager had no clue what this all meant. He called legal and a panic look came over his face and told us the bank would not open the account. I see KnowLaw opened this type of account in March 2011 with Wells Fargo and had no issue. So there is precedence.

Is it recommended that if the bank refuses to open the account with this verbiage that one files a complaint with the Office of the Comtroller of the Currency [OCC] - along with sending copies of this complaint to the federal and state representatives? Will the OCC bother to do anything? Tony

Comment

-

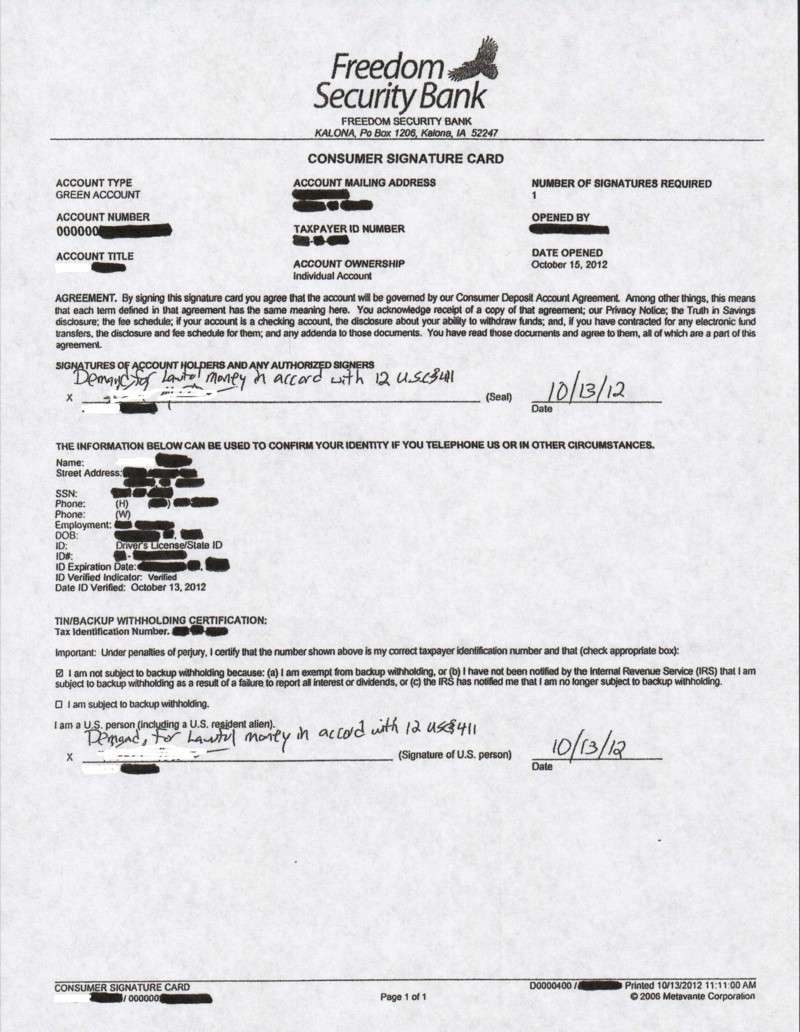

This demonstrates the fruit of vigilance:

What I like to add is that the suitor likely requested a copy of that check that he struck through the Demand. That way he had evidence of his demand just the same - probably better testimony and an indictment against the bank manager!I opened an account with a local bank on October 13, 2012. For three months there was not one peep about the demand for lawful money I included on the signature card (attached) or as a restrictive/non-endorsement on checks.

On Friday January 25 I received a call from the Bank Manager stating that it was new bank policy, effective February 1st, that they no longer accept a signature card with additional verbiage and no longer accept restrictive endorsements with a demand for lawful money on checks for deposit. If a new signature card was not signed and on file by February 1st, the bank would close the account.

I asked to have a copy of the bank's new policy but they were unable to provide it because it is not in writing. So I asked to have the bank put it in writing in a letter and send a blank signature card with said letter. The bank manager agreed and said a letter would be sent.

The following day, January 26th I went to the bank to make a deposit, and since the new bank policy was not in effect until February 1st, I still placed a demand for lawful money on the backside of the check for deposit. The bank manager was on duty and when the teller saw the demand on the check she asked the bank manager if the demand was ok. He said they would not accept it and suggested I strike through the demand and initial it.

I said I'd wait for the letter with the bank policy in writing before making any changes to the written demand on the check. The banking manager said he had talked to his supervisor and that they had nothing to put in writing so I would not be receiving a letter. He then handed my a blank signature card to sign before the February 1st date when they would close the account if a new one was not on record without the demand.

So I provided the bank manager and the teller with a verbal demand for lawful money and then struck through the demand on the back side of the check.

I left after the deposit was made with the blank signature card for me to sign and return before February 1st.

Turns out I didn't accept their request to sign a new signature card and the attached Signature Card with the Demand for lawful money is still on record at the bank. The account is still open and yesterday [2/9/13], when I made the third deposit since the February 1st date, the bank manager was there to witness that I have overcome.

NicknameLast edited by David Merrill; 02-11-13, 03:04 PM.

Comment

-

For a short while I was employed editing tariffs for LD phone companies. I think that all government regulated companies have a custom form called a tariff. The tariffs for banks are likely 3-ring binders some 75 pages in length.

I recall one suitor asked the bank manager for the tariff and it took them a half hour to "find" it for him. He was allowed to peruse through the bank's tariff while sitting in the lobby.

I commend the above suitor for rejecting the bank has a new policy - just not in writing!

Comment

-

Congrats on the sig card. I refused to come in and sign a new one and US bank closed my account. They have a clause buried in their contract that states that they can close the account for any reason. Hopefully your bank doesn't have such a clause and they will allow it to remain open.

I noticed the psuedo W-9 with the U.S. person (a flowthrough entity that handles US earned income (taxable income) being paid to a foreign entity) which leads me to ask these questions.

1. Does making your DEMAND for lawful money override the presumptions of the U.S. person?

2. Is every bank account holder a U.S. person?

3. Is it possible to open a bank account and be a non-U.S. person?Last edited by gdude; 02-11-13, 05:27 PM.

Comment

-

That is why it is important to note at the top, only one signature is required. So you sign only one clause or the other.Originally posted by gdude View PostCongrats on the sig card. I refused to come in and sign a new one and US bank closed my account. They have a clause buried in their contract that states that they can close the account for any reason. Hopefully your bank doesn't have such a clause and they will allow it to remain open.

I noticed the psuedo W-9 with the U.S. person (a flowthrough entity that handles US earned income (taxable income) being paid to a foreign entity) which leads me to ask these questions.

1. Does making your DEMAND for lawful money override the presumptions of the U.S. person?

2. Is every bank account holder a U.S. person?

3. Is it possible to open a bank account and be a non-U.S. person?

P.S. Or possibly that means that only the Agreement needs to be signed. The lower portion is voluntary.

Comment

-

Huh? I don't understand your post......I only signed once.Originally posted by David Merrill View PostThat is why it is important to note at the top, only one signature is required. So you sign only one clause or the other.

P.S. Or possibly that means that only the Agreement needs to be signed. The lower portion is voluntary.

The Banks terms of agreement had the clause, not the signature card.

Comment

-

Maybe gdude IMHO the answers might rely on definitions of law.which leads me to ask these questions.

1. Does making your DEMAND for lawful money override the presumptions of the U.S. person?

2. Is every bank account holder a U.S. person?

3. Is it possible to open a bank account and be a non-U.S. person?

1) Read the law and look at all the restrictions in it

2) 2 might answer 3

The reason why I am posting this in a different view is a friend who went to renew the government drivers licenses I.D. got a little frustrated when this error message came on when the transaction did not go through.

Last edited by Chex; 02-12-13, 04:28 PM."And if I could I surely would Stand on the rock that Moses stood"

Comment

-

I was talking about the two signatures on the Freedom Security Bank agreement above.Originally posted by gdude View PostHuh? I don't understand your post......I only signed once.

The Banks terms of agreement had the clause, not the signature card.

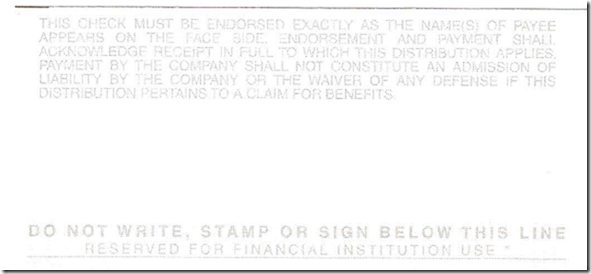

Here is a new verification that has shown up on the backside of paychecks!

Comment

-

Not all Bank of America branches are cooperative. I filed my demand with the Registrar of Deeds for the county, then sent the bank a certified copy by certified mail. The bank returned it, stating that it 'had no legal significance.' I resent it, with a letter stating that if they refused to redeem FRN's, then the income tax was unconstitutional. The bank sent this response: "We are in receipt of the purported Notice and Demand for Lawful Money. We have also received a second request Dated July 15, 2012, based on our reply. Please be advised that this document also has no legal relevance and therefore, no action has been taken or is required by the bank. We are therefore returning this document to you as well, and still consider the matter closed." signed by Anthony Petrella, Banking Center Manager II, etc.

I am preparing my 1040A form now, and will include a letter stating the particulars of the Notice filed with the county (including a certified copy), and the dates of the letters sent to the three banks that I use. The letter states that since lawful money is 'income from a non-taxable source, such transactions should not be reported on Form 1040, as it is specifically for reporting of taxable income.' So we will see if the IRS takes the same view as Bank of America...

Bank of America also states in their Account Agreement (available only online) that their policy is to ignore any special conditions written on the back of the check. But their Account Agreement does not say that the account must be held in FRN's, only in dollars.

Comment

-

It would be great if you could scan and sanitize those letters and attach them please?Originally posted by Freed Gerdes View PostNot all Bank of America branches are cooperative. I filed my demand with the Registrar of Deeds for the county, then sent the bank a certified copy by certified mail. The bank returned it, stating that it 'had no legal significance.' I resent it, with a letter stating that if they refused to redeem FRN's, then the income tax was unconstitutional. The bank sent this response: "We are in receipt of the purported Notice and Demand for Lawful Money. We have also received a second request Dated July 15, 2012, based on our reply. Please be advised that this document also has no legal relevance and therefore, no action has been taken or is required by the bank. We are therefore returning this document to you as well, and still consider the matter closed." signed by Anthony Petrella, Banking Center Manager II, etc.

I am preparing my 1040A form now, and will include a letter stating the particulars of the Notice filed with the county (including a certified copy), and the dates of the letters sent to the three banks that I use. The letter states that since lawful money is 'income from a non-taxable source, such transactions should not be reported on Form 1040, as it is specifically for reporting of taxable income.' So we will see if the IRS takes the same view as Bank of America...

Bank of America also states in their Account Agreement (available only online) that their policy is to ignore any special conditions written on the back of the check. But their Account Agreement does not say that the account must be held in FRN's, only in dollars.

What you have is Proof of Service. I think that Registered Mailing or better yet professional process server to the local Federal Reserve Bank would finish that process.

We have a verbal report from a suitor that accounts were closed and employees fired over not giving "special" treatment to the funds demanded redeemed in lawful money. Also, we have a few reports about a suitor doing nothing and the account being closed.

Yours has a different flavor. The attorneys (presuming this is signed by legal counsel) are trying to convince you that your demand has no legal relevance? That is a new tact if memory serves me. To go through the trouble of informing you that your demand has no legal relevance and return your papers to you. The letter in itself is proof of service and they even refer to your demand. Therefore if they lump your funds into reserve funds for fractional lending they have composed their own confession for counterfeiting money and filed that confession in a court of competent jurisdiction - you.

This does beg the question however; are you accepting and receiving interest from any of these accounts?

Regards,

David Merrill.

Comment

-

Originally posted by Freed Gerdes View PostNot all Bank of America branches are cooperative. I filed my demand with the Registrar of Deeds for the county, then sent the bank a certified copy by certified mail. The bank returned it, stating that it 'had no legal significance.' I resent it, with a letter stating that if they refused to redeem FRN's, then the income tax was unconstitutional. The bank sent this response: "We are in receipt of the purported Notice and Demand for Lawful Money. We have also received a second request Dated July 15, 2012, based on our reply. Please be advised that this document also has no legal relevance and therefore, no action has been taken or is required by the bank. We are therefore returning this document to you as well, and still consider the matter closed." signed by Anthony Petrella, Banking Center Manager II, etc.

I am preparing my 1040A form now, and will include a letter stating the particulars of the Notice filed with the county (including a certified copy), and the dates of the letters sent to the three banks that I use. The letter states that since lawful money is 'income from a non-taxable source, such transactions should not be reported on Form 1040, as it is specifically for reporting of taxable income.' So we will see if the IRS takes the same view as Bank of America...

Bank of America also states in their Account Agreement (available only online) that their policy is to ignore any special conditions written on the back of the check. But their Account Agreement does not say that the account must be held in FRN's, only in dollars.

Yes, please sanitize and post your letters as well the letters from the bank. I just read the Miracle on Main Street, and just didn't realize this one man, F. Tupper Saussy, for a short period put the banksters in the back seat. He started a small revolution with the law. As David repeatedly states, a remedy must exist for those competent to give it. I feel a technique to prove this out through correspondence with banks/IRS/gov't officials is needed for it to take hold. Freed, you seem to be on to something. IMO, in your letters, lawful money must be recognized and separated from other currency. It also needs to be certified by the IRS as non taxable, in letter form. We have a few on this site showing suitors receiving full return of with holdings, suitors not obliged to pay back taxes because "some" of the income was in lawful money. But a correspondence from the IRS with the words "lawful money" in them, although might be a dream, is necessary.

Freed, I wanted to see on the letter where the bank states "since lawful money is income from a non-taxable source, such transaction should not be reported on Form 1040..." Excellent work, and your diligence is not only appreciated, but necessary.

Changing the law 31 USC 371 only kicked the can further down the road. It just set up another barrier, the remedy still exists. David, your work is admirable, and of the same revolutionary path as Saussy. Money has no meaning to date, at least last I checked. It's been changed a great many times over the years and now the clear definition does not exist.

Comment

-

We are changing the history of mankind.

Comment

Comment